The cryptocurrency market might see that the worth of Bitcoin (BTC) reaches an unprecedented mile outstanding technological govt.

Daniel Roberts, founder and CEO of Iren

Daniel Roberts, founder and CEO of the Bitcoin mining of Wall Road, which is quoted on the inventory market Institutional adoption might increase the worth of cryptocurrency to new heights.

“When you contemplate the historic value trajectory of Bitcoin, it might shock me if we aren’t in 1,000,000 of $ 1 by 2030 given the traction of the ETF and the institutional buy now,” mentioned Roberts, quoted by Residing cable markets.

The cryptocurrency, at the moment contributing round $ 100,000, has already revealed a achieve of 120% throughout the previous 12 months, exceeding conventional belongings as Wall Road giants undertake increasingly more digital currencies.

Present value of Bitcoin. Supply: coinmarketcap.com

Why Bitcoin might depart gold on mud

Roberts, a former Macquarie banker, additionally attracts a marked comparability between Bitcoin and Gold, evaluating the connection with “Digital versus analog” or “Netflix versus Blockbuster.”

“Bitcoin is best to be gold, than gold,” Richardson mentioned. “It is extra scarce, simpler to switch and simpler to divide. So, all these traits that give gold worth, Bitcoin is objectively higher. “

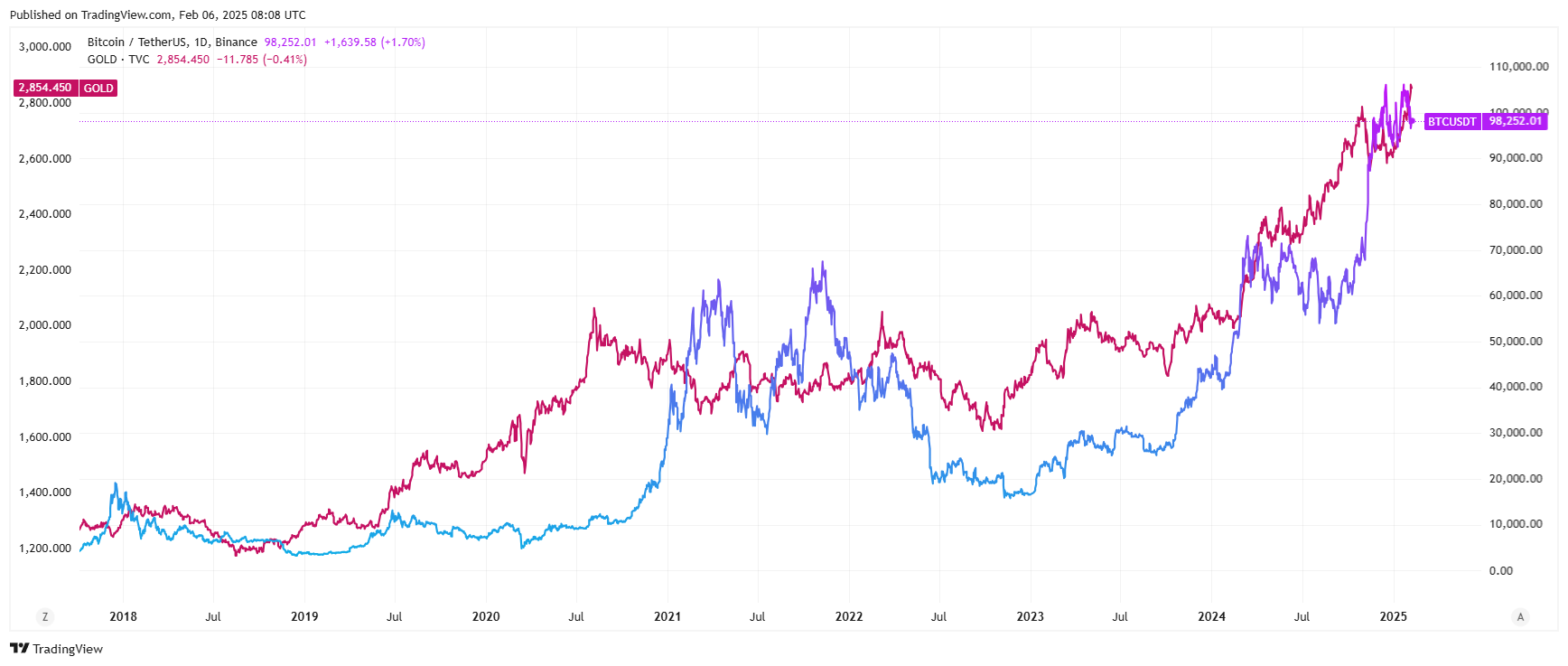

In the meantime, Gold just lately reached a document of $ 2,840 per ounce, pushed by inflationary issues and larger bodily demand, as evidenced by the negotiation volumes of Comex futures for February 2025.

Bitcoin Prive vs. Gold Worth. Supply: TrainingView.com

Iren vs. Bitcoin

Richardson’s firm, Iren, who operates information facilities for Bitcoin Mining and AI Providers, has attracted investments of the principle monetary establishments, together with Constancy, Investco and Citadel.

Though the actions of the mining firms are thought-about an oblique publicity to Bitcoin for buyers, the actions of the previous vitality of the Iris haven’t arisen as dynamically because the oldest cryptocurrency on the planet. In 2024, they gained 37%, however at the moment, they’ve rather less than 13%.

Iran, like the whole cryptocurrency business, faces challenges. BTC document costs include quickly elevated mining difficulties, which will increase the price of producing a single bitcoin. Firms can extract much less because of the rising hash price, whereas larger upkeep prices are devoted to their margins.

Iran’s struggles turned evident in mid -2023 when the corporate reported a lack of $ 29 million. Whereas this marked a six -time discount within the debt of the $ 172 million reported a 12 months earlier, it highlights the difficulties of the cryptographic mining enterprise.

In response, the corporate has determined to hitch the rising tendency to reuse its information facilities to assist excessive efficiency pc science. Nonetheless, he has confronted a collective declare that alleges that he misrepresented his capacities and future views for buyers.

Will Bitcoin attain $ 1 million? Prediction of specialists 2025 and past

The chance that Bitcoin arrives on the extremely anticipated $ 1 million model stays a problem of intense hypothesis. In response to Jeff Park, head of Alfa Methods in Bitwise Asset Administration, a key catalyst might promote Bitcoin to this milestone: the institution of a strategic Bitcoin reserve backed by the US authorities. Nonetheless, the chance that such an initiative materializes in 2025 is estimated at lower than 10%.

“The concept of a Federal Bitcoin strategic reserve that happens in 2025 is lower than a tenpercentchance occasion,” Park mentioned about X (beforehand Twitter). “That’s the solely arithmetic through which Bitcoin can attain $ 1mm+ in 2025 when it occurs.”

The concept of a Federal Bitcoin strategic reserve that happens in 2025 is lower than a tenpercentchance occasion.

That’s the solely arithmetic through which Bitcoin can attain $ 1mm+ in 2025 when it occurs.

– Jeff Park (@dgt10011) December 26, 2024

Park’s prognosis means that though Bitcoin reaching seven figures is theoretically doable, chance stays skinny with out important institutional or authorities intervention. He particularly hyperlinks this state of affairs with the creation of a Federal Bitcoin reserve, which means {that a} strategic accumulation of Bitcoin by the US authorities might dramatically influence the dynamics of provide and demand.

Nonetheless, many specialists have a extra optimistic imaginative and prescient of this matter. For instance, Planb believes that Bitcoin might attain this value degree as quickly as this 12 months.

Bitcoin pricing prediction desk

Frequent questions, Bitcoin 2030 pricing prediction

Will Bitcoin go to 1 million?

In response to Jeff Park, head of Alfa Methods in Bitwise Asset Administration, a key issue that would increase Bitcoin to $ 1 million is the institution of a strategic Bitcoin reserve backed by the US authorities. Nonetheless, it assigns lower than 10% chance for this to happen in 2025, which means that it’s unlikely that an evaluation of seven figures for Bitcoin within the quick time period is unlikely.

Can Bitcoin attain 1 million in 2030?

Daniel Roberts, CEO of Bitcoin Mining Firm Iren, argues that the upper traits of Bitcoin as a reserve of worth and rising institutional curiosity might carry their value at this degree.

Ark Make investments de Cathie Wooden additionally initiatives that Bitcoin might attain $ 1 million by 2030, citing elements such because the adoption of company treasure, institutional funding and even the potential curiosity of nationwide states that search to diversify their reserves.