This can be a section of the Imperial e-newsletter. To learn the whole version, Subscribe.

We’re completely destined.

Destined to undergo eternally by the psychology of huge numbers – the extra bitcoin rises in uncooked greenback worth, the extra it drops when it’s fastened. It will possibly appear much more scary than it really is.

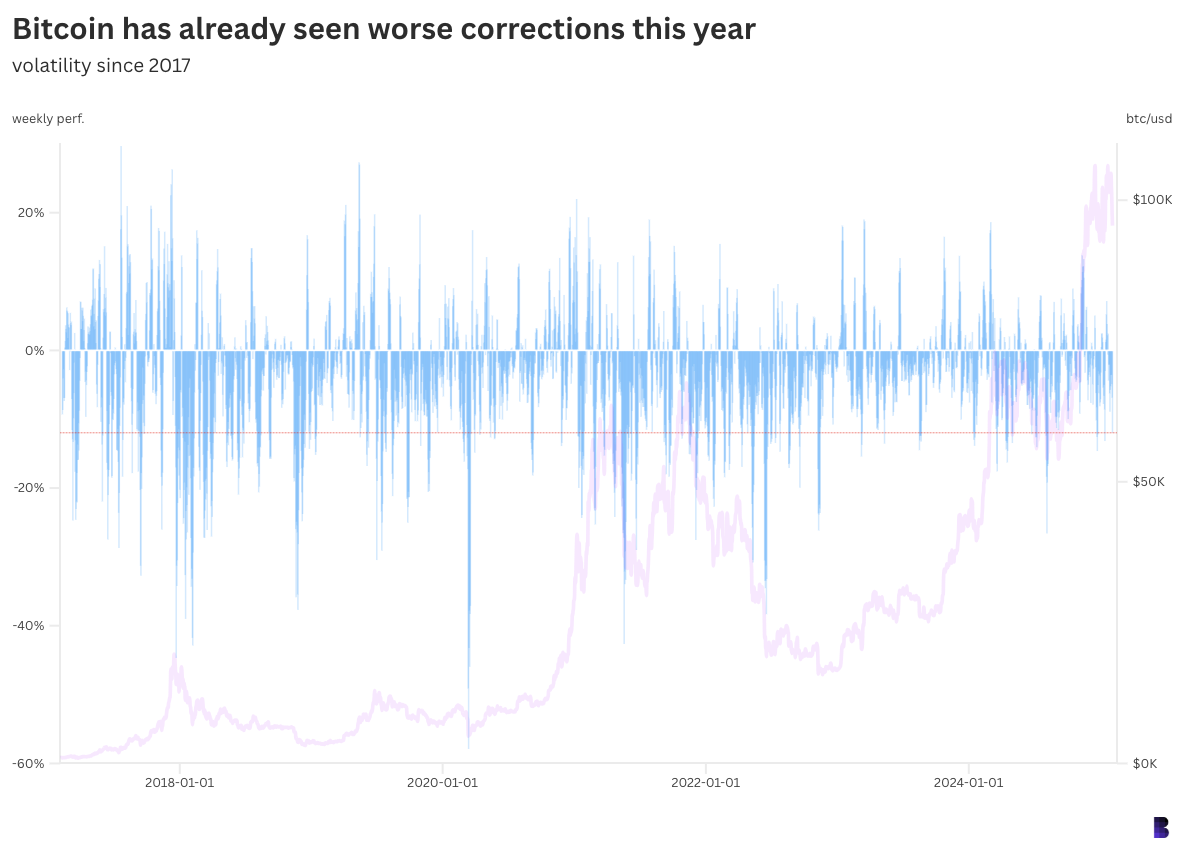

Bitcoin has minimize by as much as $18,000 since its all-time excessive on January twentieth, set hours earlier than Trump’s second inauguration ceremony (down 16.5% over two weeks).

Hopium means this is not the worst correction of 2025 to date. Within the worst case, the 12% retracement over the previous week is healthier than the 13% misplaced within the second week of January.

Bitcoin additionally fell from practically $108,300 in per week to beneath $92,500 in mid-December.

You possibly can see it within the chart above. The blue column exhibits Bitcoin’s weekly worth efficiency on a rolling foundation, whereas the orange line refers back to the whole measurement of Bitcoin’s present pullback this morning.

Such drawdowns happen repeatedly. The actual trick is to know when Bitcoin will not bounce again and put an finish to the bull market.

Extra Hopium: Traditionally, the tip of the bull market has been marked by a lot bigger short-term revisions of round 20% to 40% or extra.

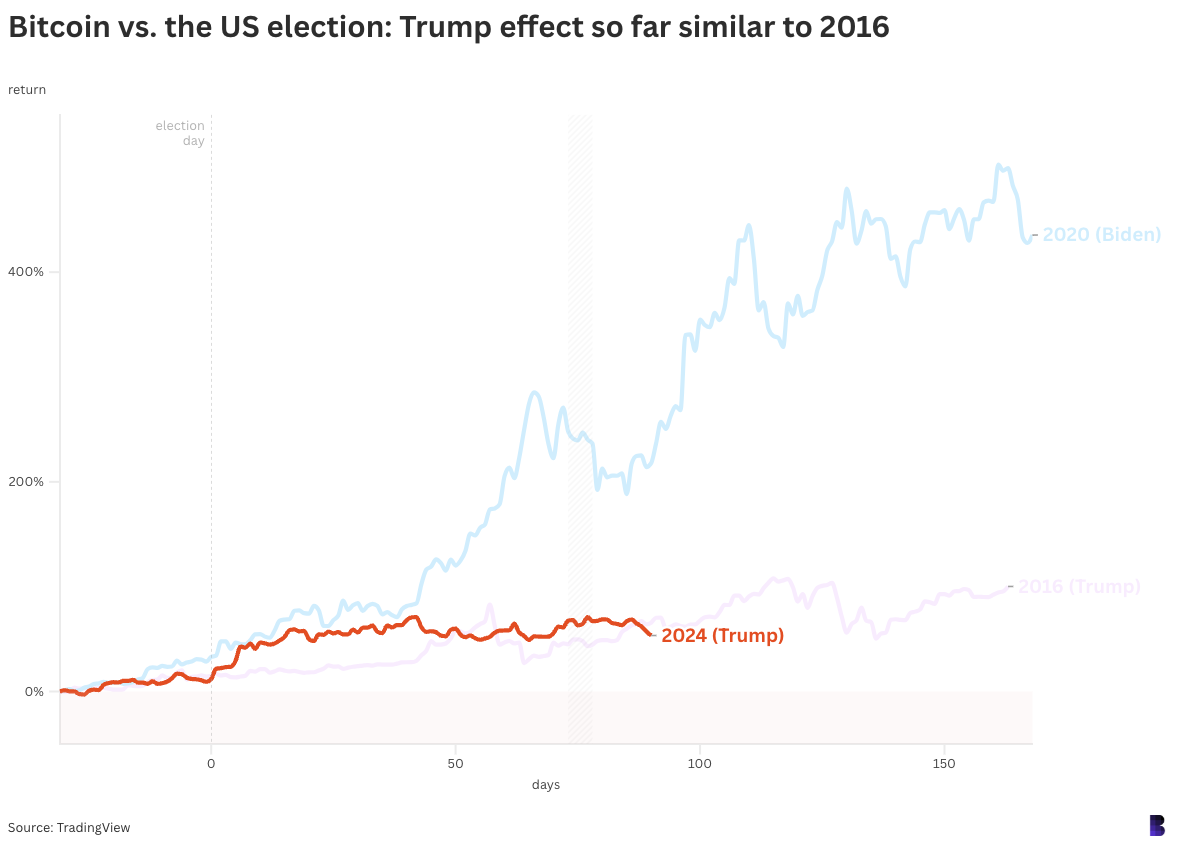

Nonetheless, so far as US election efficiency goes, Bitcoin is enduring. To date, we have been monitoring Trump’s first preparations for his first appointment in 2016.

Bitcoin, which begins 30 days earlier than Election Day till immediately, has received round 53%. In any other case, he would have revolved 66% by this time, following Trump’s victory in 2016.

Each have far under the returns posted round Biden 2020, however that is not really a good comparability, because it was through the pandemic helicopter cash period.

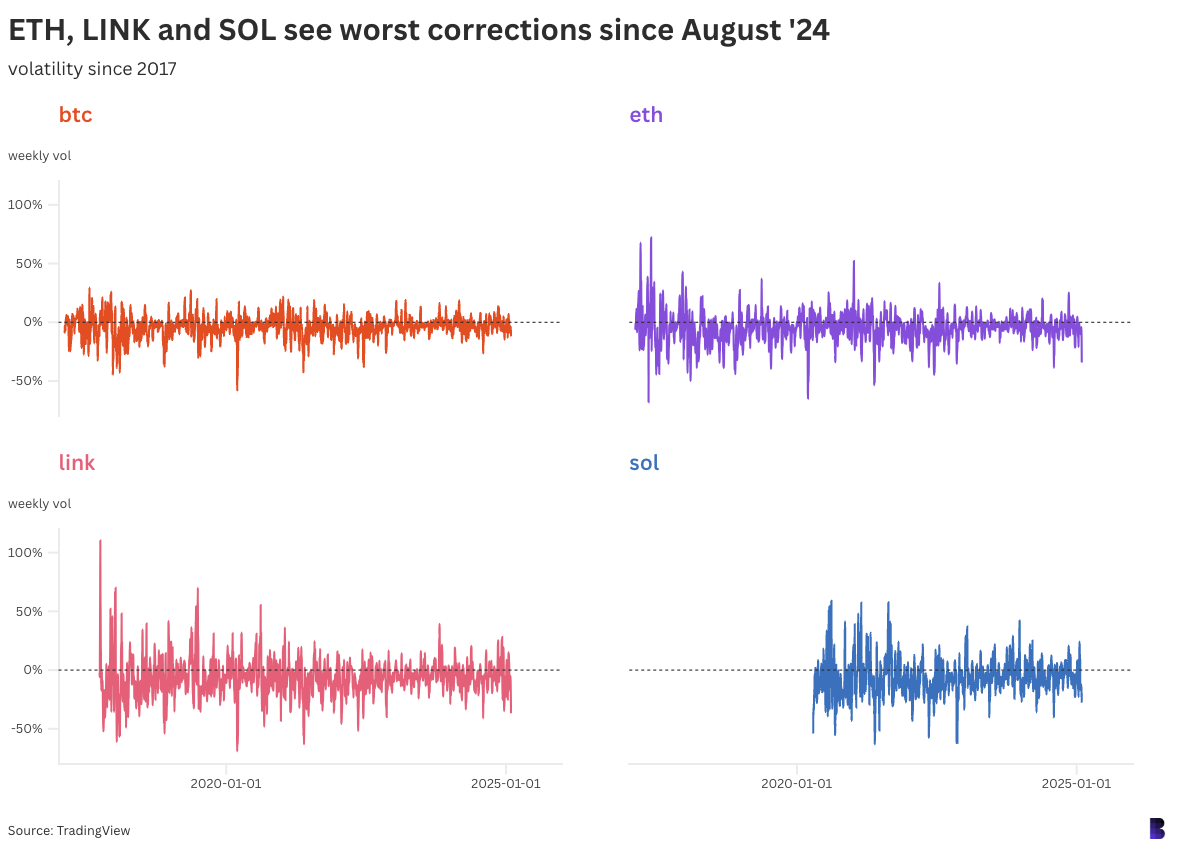

All the pieces that is not Bitcoin is essentially the most painful place. ETH has slid 34% over the previous week. I went from over $3,200 to over $2,124 earlier this morning to almost $2,600. It’s appropriate for 20% bounce.

In actual fact, all different altcoins have skilled the identical factor. Many have been a tricky month for each the crypto and inventory markets after rate of interest cuts that Powell signaled.

It was all rapidly shrugging, and right here we’re, after 5 months, about 75% larger.

Do not inform that to virtually $1.9 billion of reported leveraged longs which have been worn out within the final 24 hours. Bibit CEO Ben Zhou believes the overall might attain $10 billion.