Ethereum is regularly recovering as a result of the worth exceeds $ 3,100. This will increase 2.3 % up to now. Nevertheless, belongings are usually lowering, lowering 3.3 % in every week.

This modest rebound gives some low cost reduction, however Ethereum remains to be engaged on the general bearish tendency. Steady worth actions have revived a number of the analysts on the root of Ethereum and perceive what’s on the finish of the cryptocurrency.

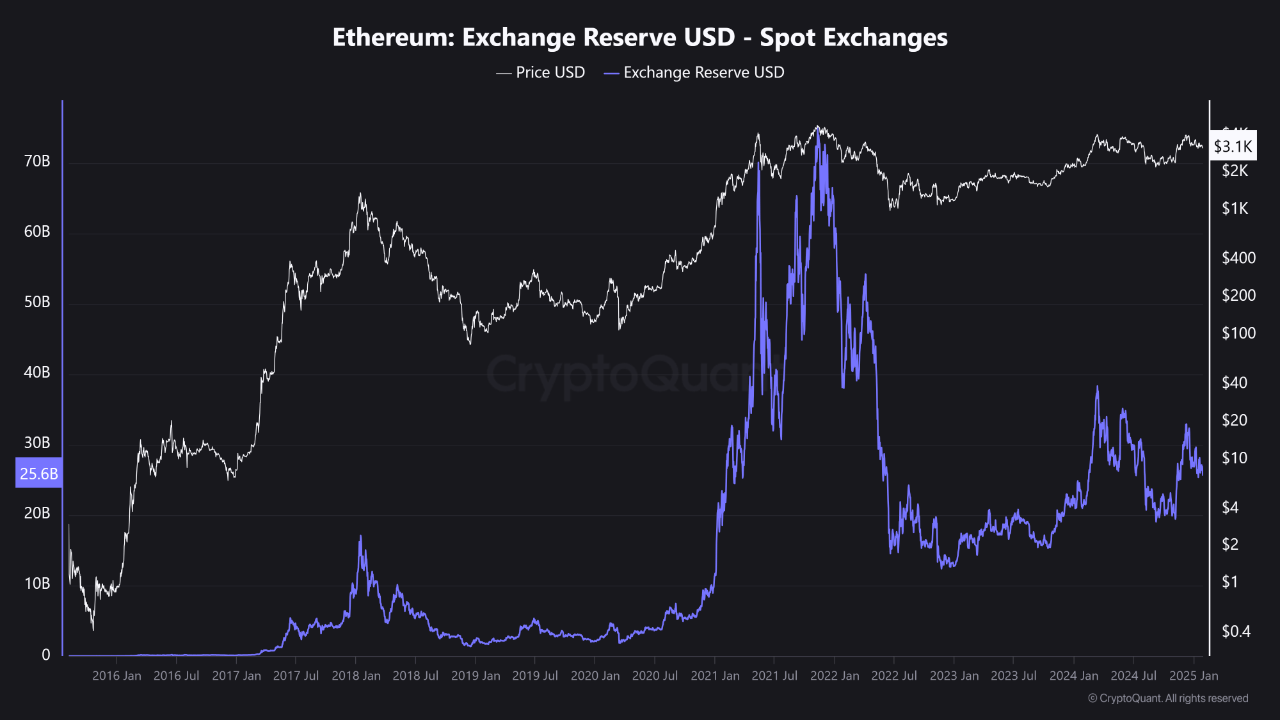

One of many essential areas of the main target is Ethereum’s spot extraction reserve. In keeping with a current evaluation by Cryptoavails, a contributor to the encrypted fast take platform, the whole reserves of Ethereum, which have been held in spot trade, are steadily declining. This lengthy -term pattern reveals modifications in how market members handle their possession.

Ethereum Spot Trade reserves the tendency

In keeping with CryptoAvails, the quantity of spot substitute reserves have modified considerably for a few years. Within the bullish market from 2017 to 2018, the reserve has peaked, as traders’ curiosity elevated quickly.

From 2020 to 2021, there was a major enhance promoted by the rise of Defi Ecosystem and Ethereum -based initiatives. Nevertheless, within the latter half of 2021, massive -scale drawers from exchanges grew to become extra widespread, and reserves started to lower sharply.

By 2023, the preliminary degree reached a low level, and by 2024, these declining ranges continued, indicating a possible scarcity of provide. The discount of the reserve typically signifies that the holder is withdrawn from the lengthy -term storage trade, relatively than preserving it obtainable for instant transactions.

Consequently, a lower in exchanges might apply stress to the worth. Cryptoavails identified that since 2022, the worth of Ethereum has begun to stabilize at the next degree as spare decreases. This sample means that low -reservoir ranges can help additional worth rise and trigger new rising developments.

ETH technical evaluation

From a technical viewpoint, Ethereum reveals a sample wherein analysts interpret it as bullish. A number of distinguished folks within the cryptographic neighborhood share their insights.

One of many well-known analysts, often known as Crypto Ceaser, has just lately emphasised the bounce of Ethereum as an essential alternative, underestimating cryptocurrencies, and could also be in a brand new historical past. I’ve expressed my opinion.

$ ETH – #Ethereum was bounced as anticipated. This was an enormous alternative. Please ship me.

For my part, Ethereum could be very underestimated. We expect we are going to quickly see a brand new ass. pic.twitter.com/ljma1Lepjo

-Crypto Caesar (@cryptocaesarta) January 28, 2025

Nevertheless, not all evaluation attracts evenly optimistic footage. Anup Dhungana, one other Crypto analyst, identified the distinction between Bitcoin and Ethereum market conduct.

Bitcoin maintains a steady uptrend, however Ethereum’s efficiency for Bitcoin is low, and the ETH/BTC pair has a low worth. This distinction displays the decline in traders’ curiosity in Ethereum in comparison with different belongings.

In keeping with DHUNGANA, the subsequent technical help degree of ETH/BTC could also be between 0.028 and 0.026. The rebound from this degree has probably revive a broader curiosity in Ethereum and Altcoin, and has a technique to one other stage of development.

Particular picture created by Dall-E, chart of TradingView