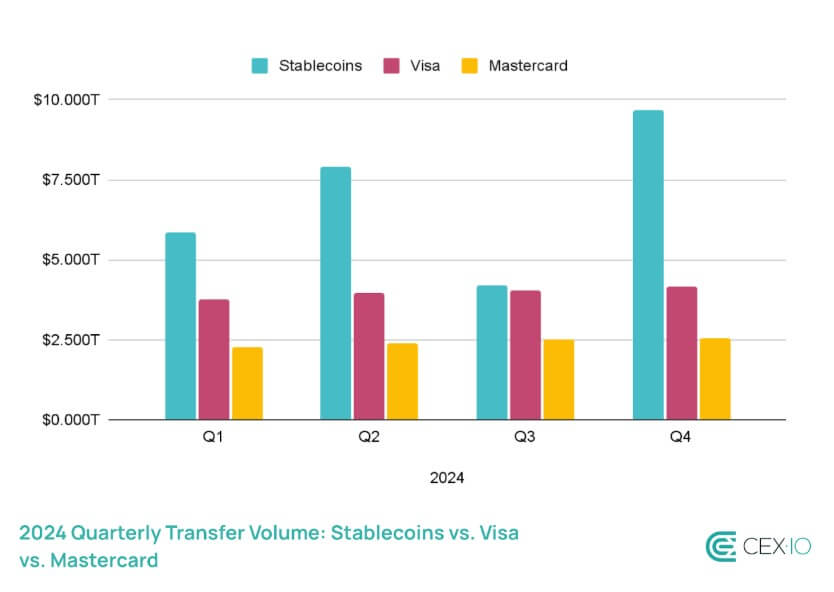

In line with Crypto Trade Cex.io experiences, StableCoin switch reached $ 27.6 trillion in 2024, exceeding the overall transaction quantity of Visa and MasterCard by 7.68 %.。

The report identified that StableCoins is extra constant than standard fee suppliers all year long, even if DIP decreased within the third quarter resulting from a big market deceleration.

This pattern exhibits modifications in world remittances as a result of legacy suppliers similar to Western unions and moneygrams are affected by the rising demand for digital property.

StableCoin’s provide elevated by 59 % throughout this era, exceeding $ 200 billion. With this progress, stubcoins accounted for a complete of 1 % of US {dollars}, which considerably elevated from 0.63 % of the yr.

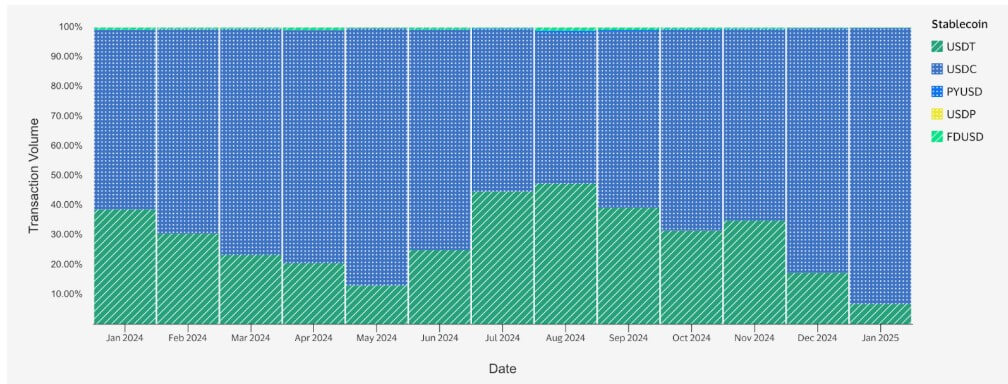

USDC leads as Solana beneficial properties management

Circle USDC appeared as a dominant stubcoin for on -ene transactions, accounting for 70 % of the overall switch capability. Nonetheless, the short-term lower in Defi actions has barely weakened in Q3.

The USDT of Tether, the most important stubcoin in market capitalization, has skilled vital progress and has doubled the overall motion. However, its market share decreased from 43 % final yr to 25 %.

SOLANA grew to become essentially the most energetic blockchain of StableCoin switch in January 2024, overtaking Tron and Ethereum. The fast enhance in Solana -based actions promotes USDC market share, and 73 % of the community StableCoin Provide has been linked to USDC transactions.

In line with CEX.IO:

“This enhance is in step with the expansion of Solana’s general ecosystem as a result of stubcoin on the community was primarily utilized in Defi and different DApp actions.”

Bot gasoline StableCoin Quantity

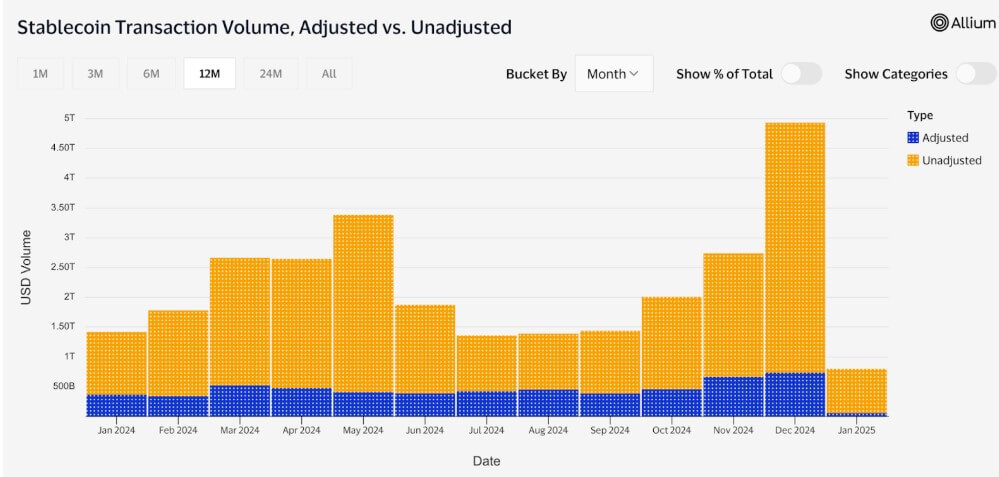

CEX.IO identified that bot -driven transactions performed an vital function in StableCoin transactions final yr and performed an vital function in computerized methods in control of 70 % of the overall quantity.

In line with the corporate’s survey, bot -led transactions have been notably dominant in Ethereum, base, and Solana.

Crypto Trade reported that the unrevoment transaction (primarily reflecting bot actions) represented 77 % of StableCoin switch in 2024. This confirmed 4 instances the rise from 2023.

Unconducted transactions have continued to exceed 98 % of whole safety actions in networks dominated by USDCs similar to Solana and Base.

This surge was promoted by these excessive transaction speeds, low value, fast revolt methods, and the fast progress of Meam token. In December alone, Memecoins accounted for 56 % of SOLANA’s distributed (DEX) transaction quantity.

Regardless of issues about bots that function the market by way of FrontRunning and sandwich assaults, CEX.IO identified that additionally they enhance effectivity. These automated methods can promote the ruling, execute repeated good contract transactions, and canopy person fuel charges.

CEX.IO addition:

“Consequently, the management of the bot in StableCoin transactions may signify the maturity of a particular community.”

What’s subsequent to StableCoins?

Exchanges said that StableCoins has solidified as a necessary fluid supply for DEFI, transactions, and borders funds in 2024. This tendency is predicted to final in 2025 within the after -harvest cycle, which traditionally will increase the stream of transactions and capital.

Provide enlargement might proceed. The corporate said that the earlier market cycle has said that stubcoin progress has grown past the bullish stage, and is usually sustaining early recession. For instance, in 2022, StableCoin Provide continued to rise till March. That is 5 months after the height of the market. This implies that demand stays secure, even when the broader market state of affairs is weakened.

One other vital growth features a shift past the community dominated by USDT like Tron. The report focuses that the USDT is going through the rise in competitors and the rise in rules, which can eroded market share and have an effect on the rule of Tron in StableCoin transactions.

Alternatively, the longer term Pectra replace of EtherEum, which is predicted to be in March 2025, might improve the attraction of the community as StableCoin Hub. The improve goals to enhance scalability, cut back fuel charges, and enhance person expertise by way of Ethereum Layer 1 and Layer 2 Community as an entire.