It is a section of the Ahead Steering E-newsletter. To learn the entire version, Subscribe.

With the latest affirmation of Scott Bessent as US Treasury Secretary, we’ve got obtained the announcement of a primary quarter refund beneath his management.

Over the previous 12 months, a lot has been written concerning the potential politicization of the composition of debt issued by the Treasury and the way it will have an effect on the market.

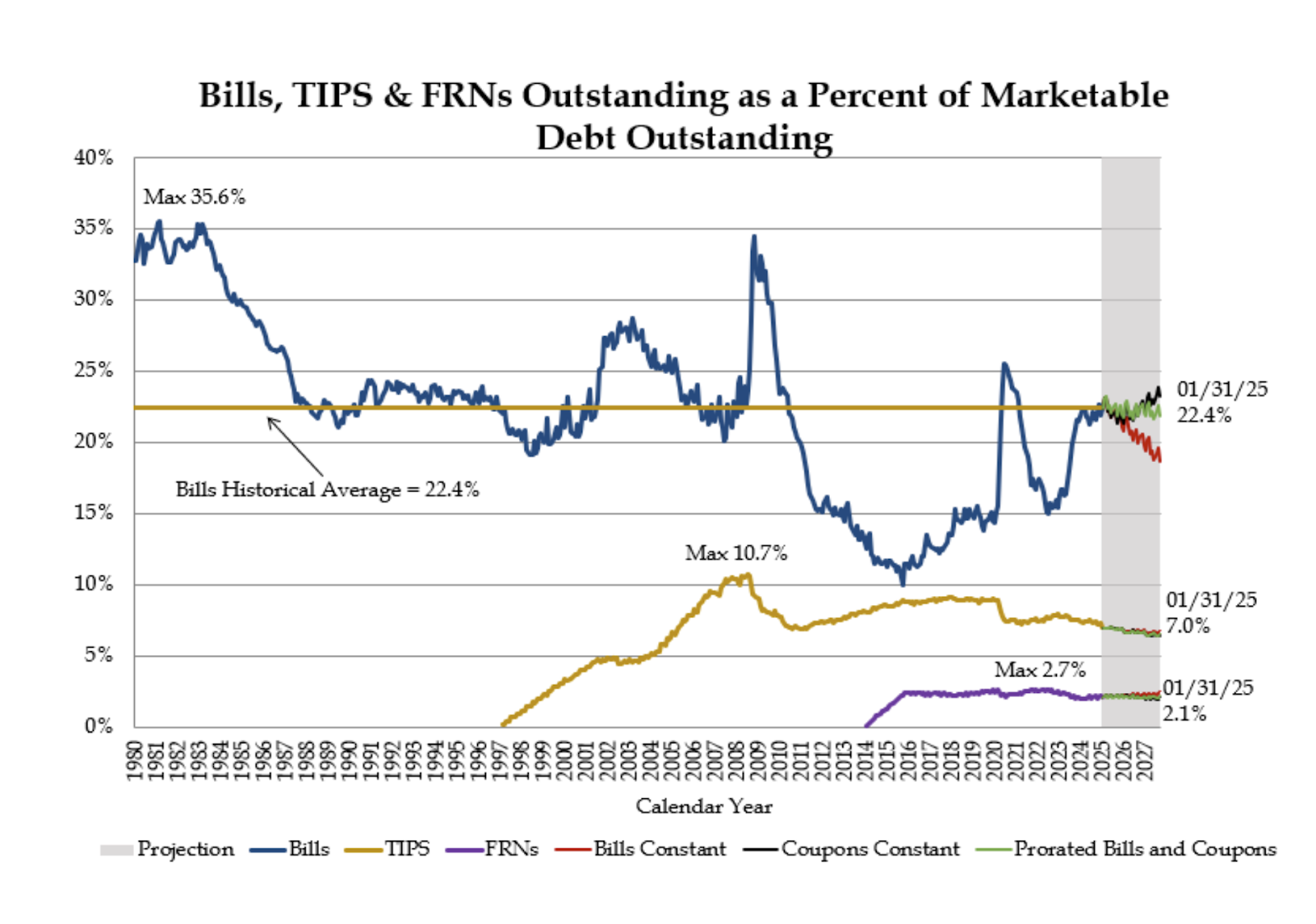

As proven under, the proportion of payments issued in comparison with coupons has elevated sharply. Traditionally, any such maneuvering has been maintained in instances of disaster when the Treasury should elevate some huge cash in a short time and have little influence on the interval.

Nonetheless, this happens in a regime of outstanding financial power.

Earlier than being appointed as a secretary, Becent was publicly essential of this technique. He argued his perception that the composition of issued money owed is crucial to normalising. This implies a rise within the proportion of long-term debt issued.

Although praiseworthy, this technique has resulted within the lack of long-term structural demand for bonds with out the Fed shopping for for QE, international central banks change into internet sellers of long-term debt, and considerations about monetary obligations It is vitally unstable because it will increase.

In that context, there was all eyes on this week’s QRA, and we noticed whether or not Bessent would return the configuration of the publication to normalization.

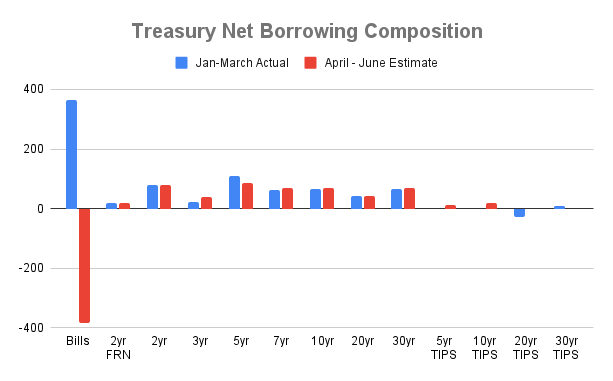

As seen within the chart under the estimate for borrowing for the subsequent two quarters, Bessent tilted the road and maintained the coverage method he criticized Yellen.

What’s much more fascinating is the dedication to the advance steering of this publication, launched final 12 months. Regardless of suggestions from Steering TBAC, the Ministry of Finance has determined to take away it.

“When discussing the issuance suggestions, the committee uniformly inspired us to think about eradicating or modifying the ahead steering for nominal coupons and FRN public sale sizes that had been featured within the refund statements for the previous 4 quarters. Some members most well-liked to loosen up the language at this assembly, however choose to drop the language completely to replicate the unsure outlook.”

Regardless of this suggestion, the Treasury maintained its following dedication:

“Based mostly on present forecast borrowing wants, the Treasury expects to keep up nominal coupons and FRN public sale sizes for a minimum of the subsequent few quarters.”

So, what’s the takeaway? I will depart a meme behind: