Bitcoin worth actions are at all times topic to dialogue between buyers and analysts. Many individuals are questioning if Bitcoin has already peaked on this bullshicle on account of current retraces. On this article, we look at knowledge and metric on chains to judge the situation of the Bitcoin market and the potential future motion.

For detailed full evaluation, see the unique the place the worth of bitcoin has already peaked. Full video presentation out there on YouTube channel of Bitcoin Journal Professional.

https://www.youtube.com/watch?v=fvjh-cjxcya

Bitcoin’s present market efficiency

Bitcoin has lately confronted a recession of the best to 10 % of historical past, resulting in considerations concerning the finish of the bullish market. Nevertheless, the historic pattern means that such a correction is regular and regular. Normally, Bitcoin experiences 20 % to 40 % pullbacks earlier than reaching the ultimate cycle peak.

Evaluation of on -eye metric

MVRV Z rating

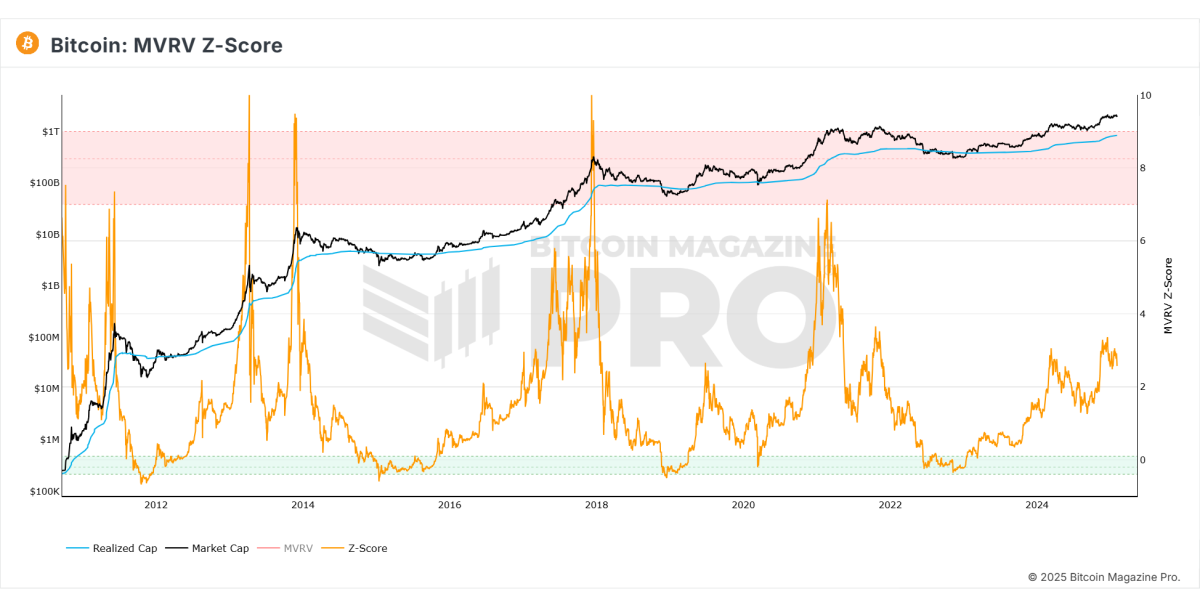

Determine 1: Bitcoin MVRV Z Rating -Bitcoin Journal Professional

The MVRV Z rating, which measures market worth, has now indicated that bitcoin nonetheless has a big rise. Traditionally, the higher a part of the bitcoin cycle happens when this metric enters the overheated purple zone, however doesn’t apply to it now.

Used output revenue margin (SOPR)

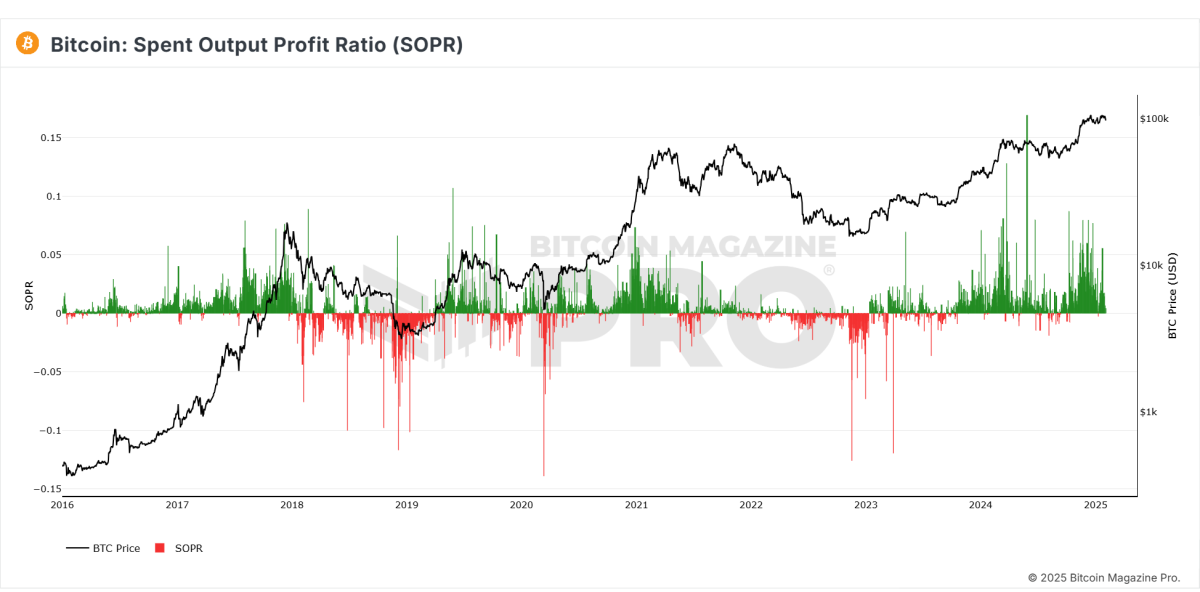

Determine 2: Bitcoin Use Output Price (SOPR) –Bitcoin Journal Professional

This metrick clarifies the ratio of used output of earnings. Not too long ago, SOPR has proven a lower in realization, suggesting that there are few buyers promoting possession and strengthening market stability.

Destroyed worth date (VDD)

Determine 3: Bitcoin: Worth Daids Destroyed (VDD) A number of -Bitcoin MagazinePro

VDD reveals the sale of lengthy -term holders. Metric has proven a lower in gross sales stress, suggesting that bitcoin is secure at a excessive degree, moderately than heading for a very long time.

Institutional and market feelings

- Institutional buyers corresponding to MicroStrategy proceed to build up bitcoin and reveals belief in its lengthy -term worth.

- The centement within the spinoff market has modified negatively, and traditionally, it has a possible brief -term worth as a result of extra leverage merchants betting on bitcoin could also be cleared.

Macro financial issue

- Quantitative tightening: Central banks are lowering fluidity and contributing to a brief lower in bitcoin.

- World M2 Cash Provide: Cash Provide’s contraction has affected danger belongings, together with bitcoin.

- Coverage on the Federal Reserve: There are indicators from main monetary establishments, together with JP MORGAN, and quantitative easing could return by mid -2025, which may enhance the worth of bitcoin.

Associated: Is $ 200,000 an actual bitcoin worth aim for this cycle?

Future outlook

- Bitcoin’s worth motion reveals indicators of an integration stage earlier than one other potential rally.

- On -fin knowledge suggests that there’s nonetheless room for development earlier than reaching the cycle peak discovered within the earlier bullish market.

- If bitcoin is additional introduced again to $ 92,000, this might have a powerful alternative to a protracted -term investor.

Conclusion

Bitcoin has skilled a brief retribution, however the on -fin metric and historical past knowledge recommend that the Burecycle has not but been over. Institutional curiosity continues to be sturdy, and macro financial situations could change with help of bitcoin. As traditional, buyers must fastidiously analyze knowledge and look at lengthy -term tendencies earlier than making funding selections.

If you’re enthusiastic about extra detailed evaluation and actual -time knowledge, contemplate checking Bitcoin Journal Professional for invaluable insights on the bitcoin market.

Disclaimer: This text is just for info provision and shouldn’t be thought to be monetary recommendation. Earlier than investing choice, we are going to at all times conduct our personal surveys.