In lower than two weeks after Donald J. Trump returned to the White Home, he has already rattled a rattling cage with a variety of controversy. The most recent was not solely a big tax on Saturday night, but additionally two neighbors, Canada and Mexico.

Given the truth that his actions got here on the weekends on weekends, this particular market was anticipated to face music.

Bitcoin slumps on weekends

The 25 % tariff in Trump in Canada was not conscious, and the latter prime minister Justin Trudeau was kindly responded by imposing the identical tax on American merchandise. Following Trump’s justifying, these taxes argued that they purpose to guard Americans, aiming to cut back the circulate of immigrants that aren’t documented or documented to the USA. I obtained it.

“We do not need to be right here. We did not search this,” however he stated his nation would “don’t retreat”, and their retaliation was “standing up for Canadians.” As well as, it was an indication.

Mexico has ready the response and China is saying that it’ll problem Trump tariffs in a worldwide buying and selling group, so the scenario appears to be removed from peak, and no escalation is seen. As well as, the US President has a signing circumstances that may impose even higher taxes, as they’re doing in retaliation.

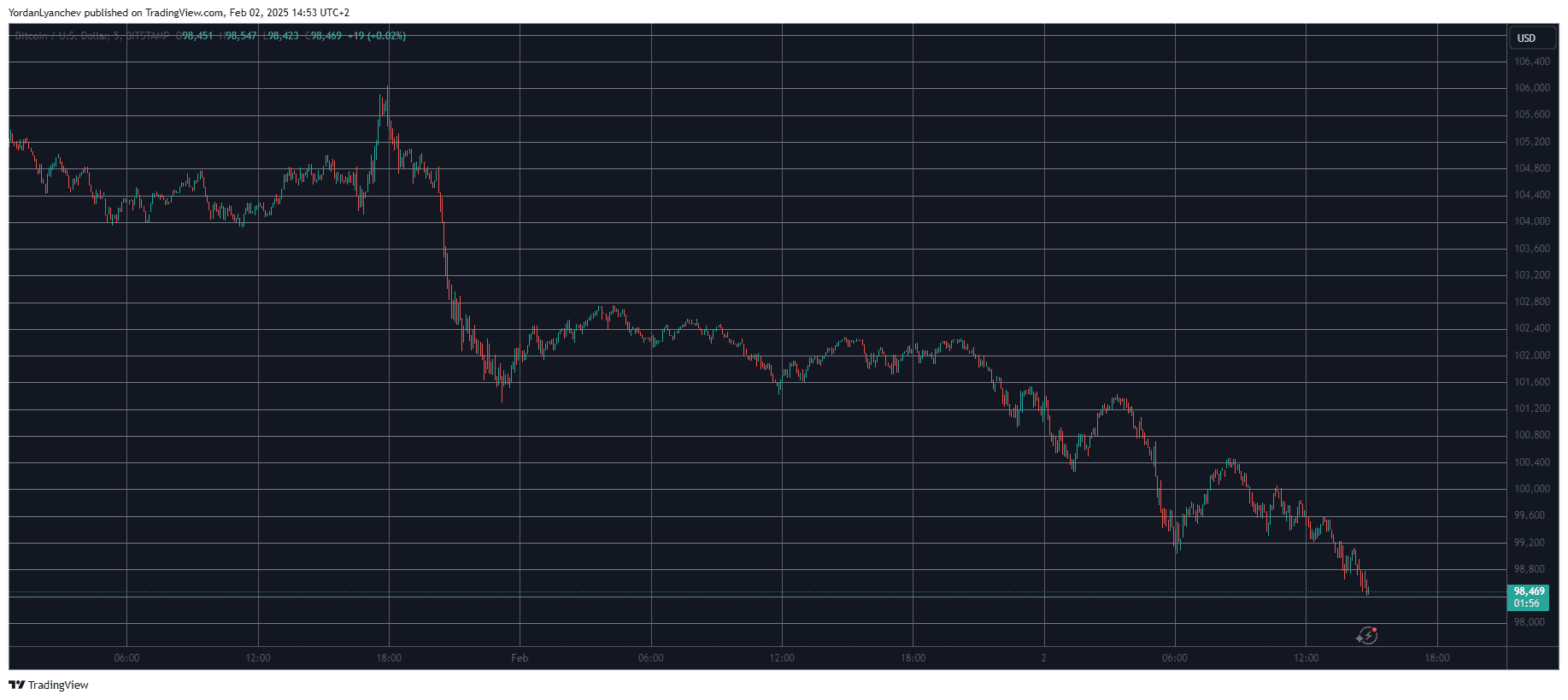

Trump’s order was signed on Saturday, so the political panorama worsened on the weekend, and the one open monetary market was hit the largest hit. The value of BTC, which is an asset that may be traded 24 hours a day, has dropped from greater than $ 106,000 on Friday to lower than $ 98,500 in the present day.

Gold Hit Ass

On the floor, the worth conduct of gold for the previous few days appears to distinction to the worth of BTC. In any case, priceless metals collided with Friday’s contemporary historical past of $ 2,820/ons. Nonetheless, the bullion additionally died after a brand new peak, and closed Friday (and January) for lower than $ 2,800.

Moreover, gold has not been seen but as a result of it has been closed for transactions on weekends, as in all shares and all different non -crypto monetary markets. Futures Markets not often supplies insights on the time of stories time, so when the Asian buying and selling session begins on Monday morning, the true image behind Trump’s actions will probably be revealed.

On the similar time, if a bigger sale happens within the subsequent few days, the influence on ciphers and BTC might worsen.