The world’s second largest market capitalization, Ethereum (ETH), has skilled a major worth drop because it types a bearish worth motion sample in its each day timeframe. Nonetheless, traders and long-term holders seem like benefiting from this market outlook and are repeatedly accumulating tokens, as reported by on-chain analytics agency Coinglass.

ETH leak value $321 million

Knowledge from spot inflows/outflows reveal that exchanges witnessed over $321 million in ether token spills in the course of the steady worth drop of Ethereum, suggesting potential accumulation It is turn out to be.

Such a spill within the bearish outlook suggests a great buy alternative, which may result in buy stress and additional upside rally.

Merchants make robust bets on brief positions

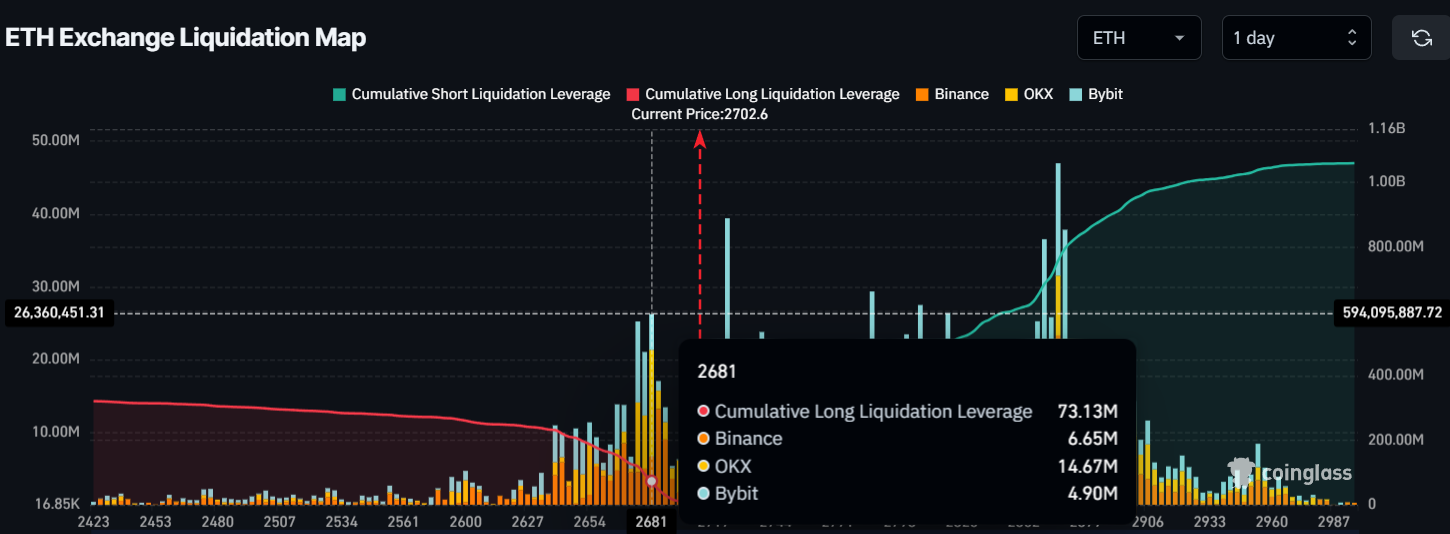

In the meantime, intraday merchants appear to comply with present market sentiments. In keeping with Coinglass knowledge, merchants are betting strongly on the brief aspect.

In the mean time, the 2 main liquidation ranges are near $2,680, with merchants holding lengthy positions value $735 million, whereas $2,780 is one other main liquidation degree, with merchants at $325 million He holds a substantial brief place.

This knowledge reveals how bears guess on present sentiments, which has led to a steady worth drop.

Present worth momentum

Ether is at present buying and selling close to the $2,690 degree and has witnessed a 1.30% worth drop within the final 24 hours. Nonetheless, throughout the identical interval, bear market sentiment and ongoing market uncertainty led to a 25% decline in its buying and selling quantity, with much less participation from merchants and traders in comparison with the day gone by.

Ethereum (ETH) Technical Evaluation and Future Ranges

All these elements recommend that knowledgeable technical evaluation has made Ethereum bearish because it seems to be persevering with to fall, failing to carry past its key help degree of $2,800. I am doing it.

Primarily based on current worth motion and historic momentum, if ETH closes each day candles beneath the $2,700 degree, there’s a robust risk that it’s going to drop 20% to achieve the $2,200 degree sooner or later.

Nonetheless, ETH’s relative energy index (RSI) is near the realm bought, suggesting a bearish development and a attainable additional worth decline.