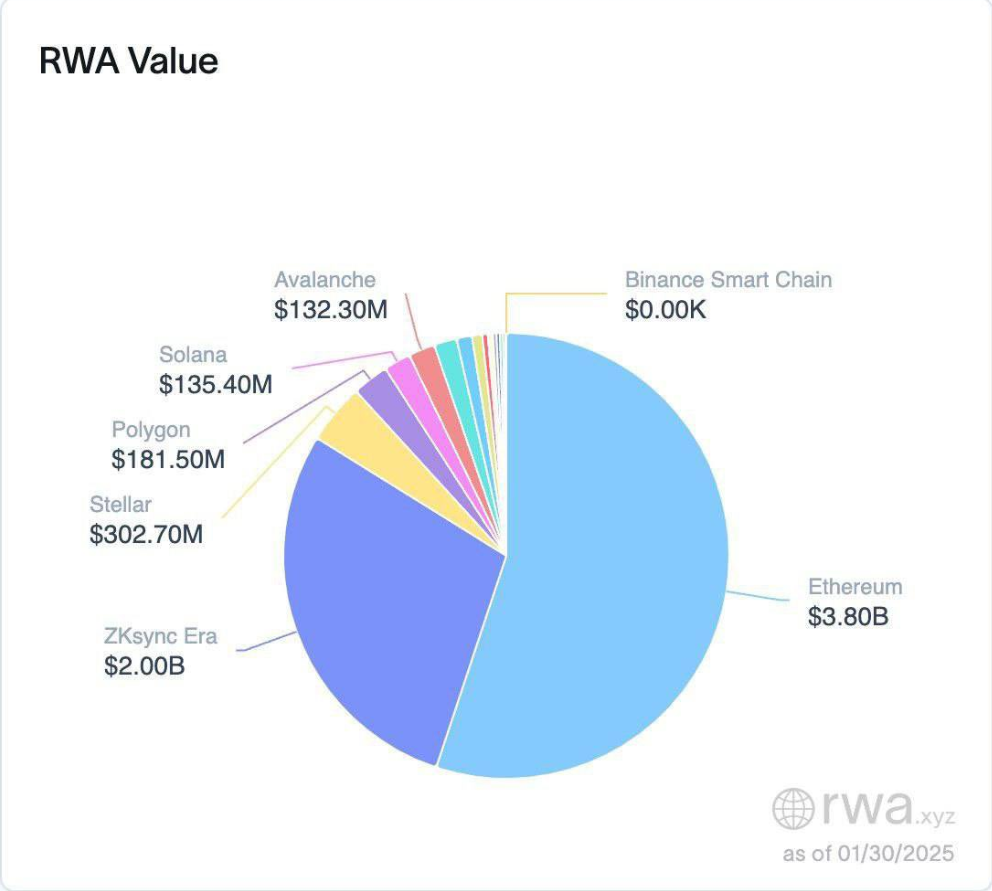

Ethereum continues to dominate the blockchain house, with 86% of the on-chain of all real-world property (RWAS) held by Ethereum and Ethereum Layer 2 options.

Regardless of Ethereum’s domination, each Bitcoin and Ethereum see a constant circulation of steady capital, suggesting cautious market sentiment.

The dearth of key altcoin motion additional signifies that the crypto market is within the consolidation part.

Ethereum dominates the true world asset market

Actual-world property allotted to Ethereum Mainnet and Layer 2 Options function at $3.8 billion whereas dominating many of the chain market.

Ethereum maintains a better lead than Solana and Polygon’s blockchain platforms, with Solana holdings $135.4 million and Polygon holdings $181.5 million.

Ethereum’s Layer 2 resolution will increase transaction throughput whereas decreasing charges, making Ethereum the best choice for builders and traders.

Supply: rwa.xyz

When working with a safe distributed structure, builders select Ethereum over different blockchain selections as a consequence of its highly effective growth ecosystem capabilities.

By means of optimism and arbitrum, Ethereum Layer 2 options push the boundaries of Ethereum capability by enabling deflation transactions at lowered prices to assist deflationary progress.

Moreover, Ethereum continues to solidify its blockchain revolution by rising the variety of RWAS shared metrics.

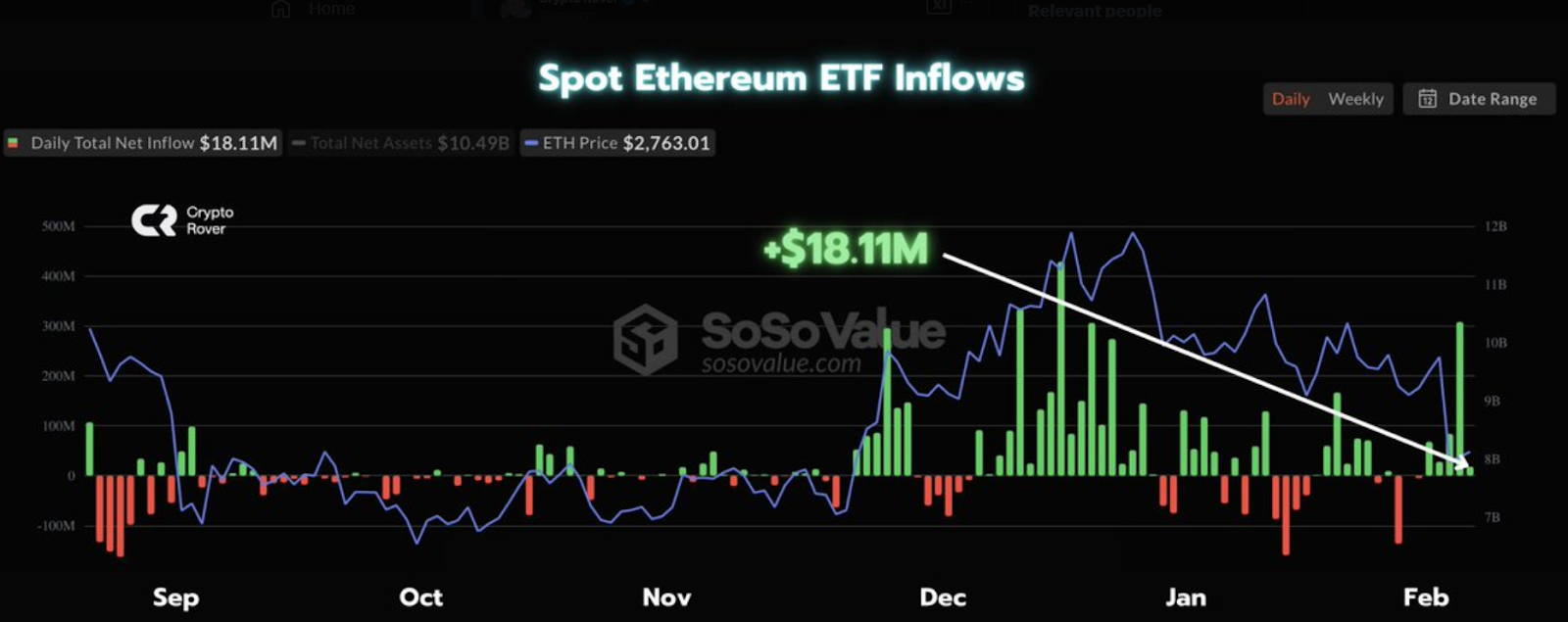

Ethereum’s current funding in Ethereum ETFs totaled $181 million as Ethereum continues to develop in recognition.

Knowledge from SoSoValue confirms that traders are rising as Ethereum calls for round $2,763 per unit.

The engaging enhance influx revealed by way of Inexperienced Bar exhibits traders are returning to Ethereum funding alternatives.

Supply: SosoValue

Ethereum worth evaluation: Main assist and potential rebound targets at $2,500

Ali chart evaluation of Ethereum costs exhibits the $2,500 function as a key assist level, establishing a elementary change available in the market course.

Ethereum will seemingly rebound upwards if it stays at $2,500 in its present buying and selling vary and maintains a worth that exceeds its resistance stage.

Future market actions will decide whether or not Ethereum costs can rise between $4,000 and $6,000.

Supply: Ali Charts

As Ethereum failed to keep up its $2,500 assist, a downward worth motion is triggered in direction of $1,700 earlier than seeing the brand new pattern.

Bully sentiment about tokens requires that the $2,500 worth stage stays the identical.

Present worth actions present that Ethereum follows a gentle upward pattern that begins in mid-2023.

Cryptocurrency is able to expertise further worth progress over the approaching months, relying on the power of its assist.

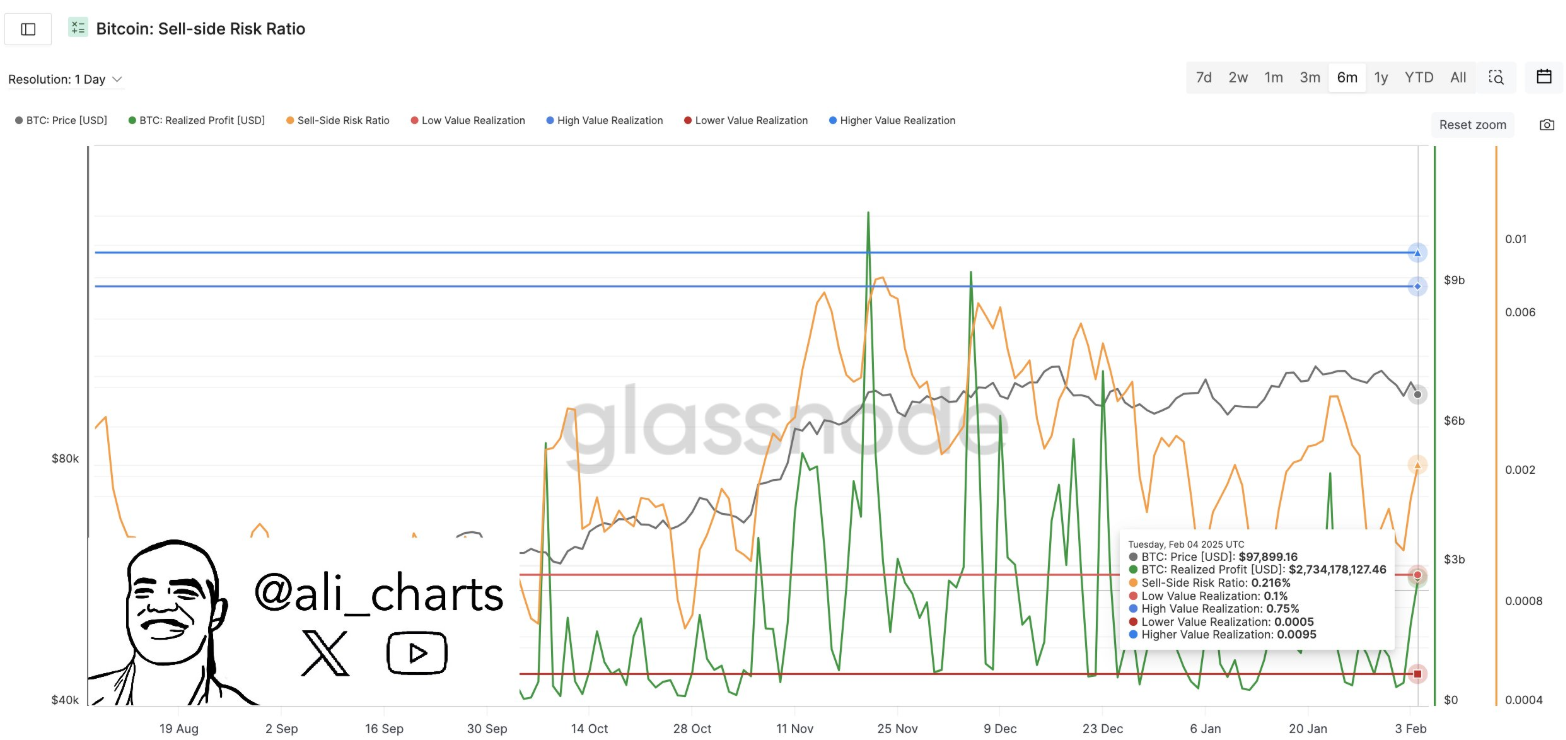

Bitcoin and Ethereum see steady capital outflow in stablecoins

Moreover, Bitcoin and Ethereum proceed to face capital outflows to Stablecoins.

Transfers of funds to Stablecoins present a longtime sample as market uncertainty helps the present stability of Stablecoins.

Stabrecoin is receiving an rising variety of capital as traders stay in place to attend for a crucial market signal.

Supply: x’s Ali Chart

The AltSeason indicator exhibits no indicators of Altseason Rally as Altcoins are under Bitcoin and Ethereum market costs.

The market is demonstrating an total conservative strategy as merchants anticipate crucial alerts, comparable to regulatory breakthroughs to drive market change, Ethereum and adjustments to Bitcoin benchmarks.

The present market state of affairs exhibits rigidity as traders hope for bitcoin momentum to surge once more or want set off occasions to begin the alto season.