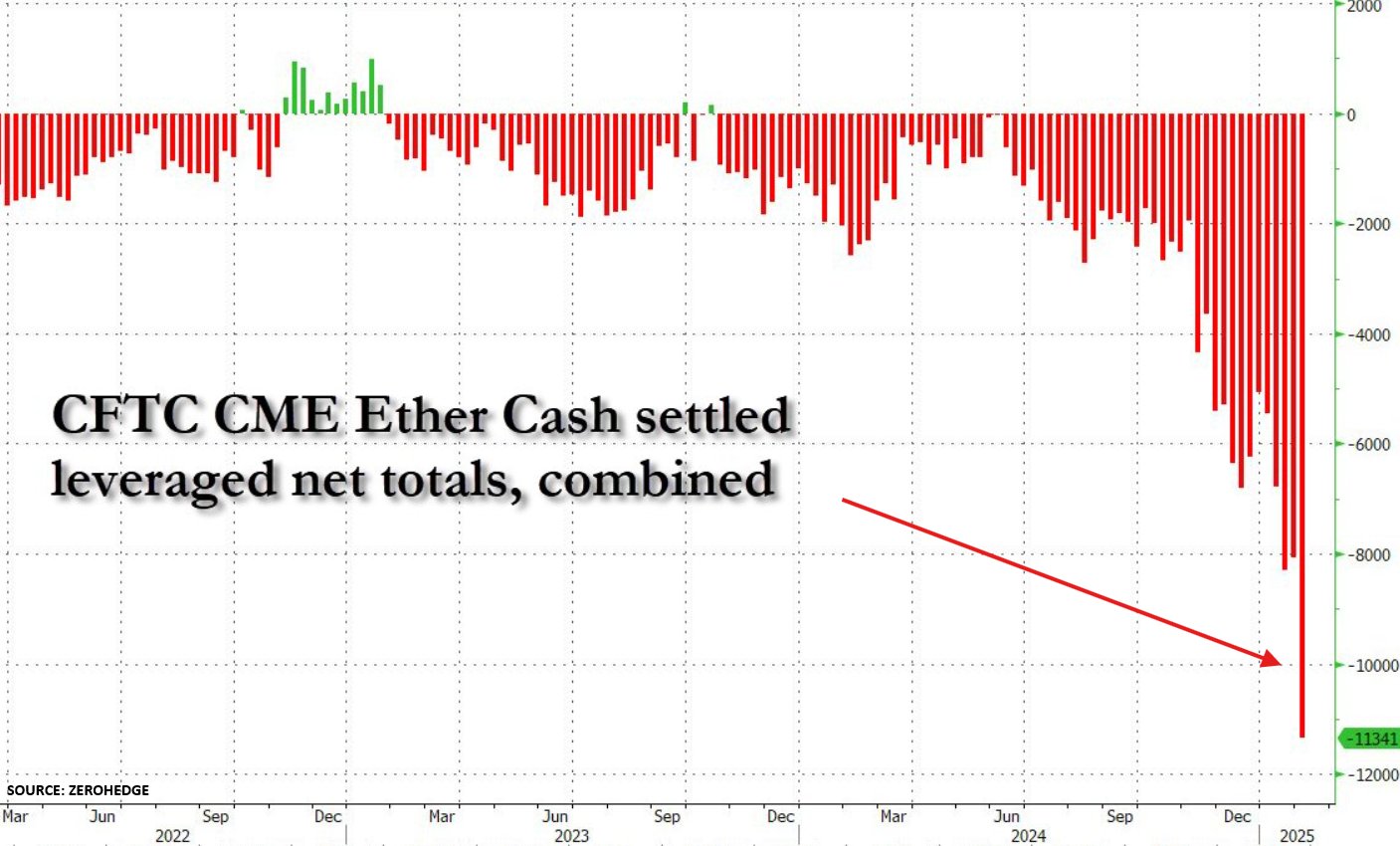

Ethereum (ETH), the second largest cryptocurrency for knowledgeable market capitalization, faces an unprecedented quick sale of protection funds. Particularly, quick positions in ETH have shot 500% since November 2024, indicating a bassist feeling excessive to the digital asset.

Are institutional buyers lose religion in Ethereum?

In response to a latest publication about X of Kobeissi’s letter, Ethereum Value is witnessing the rising challenges, for the reason that quick positioning in cryptocurrency has shot in latest occasions. Particularly, ETH’s quick positions rose 40% within the final week, whereas 500% rise within the final three months.

It’s price noting that that is the best stage that Wall Avenue funds have been transient Ethereum. Earlier this month, the cryptographic market obtained a sign of this positioning of the bearish ETH, for the reason that digital asset crashed 37% in 60 hours amid the industrial charges proposed by Donald Trump in Canada, China and Mexico.

Curiously, capital entries to the funds quoted in Ethereum Bag (ETF) have been considerably excessive in December 2024. In simply 3 weeks, Eth Ethfs attracted Greater than $ 2 billion in new funds, with a file ticket of $ 854 million.

Nonetheless, the positioning of the protection funds in ETH means that they don’t have a lot confidence within the quick -term costs perspective of the cryptocurrency. A number of components might be at stake for the diminishing curiosity of institutional buyers in ETH.

For instance, ETH is at present traded virtually 45% under its present most of all time (ATH) of $ 4,878 recorded in November 2021. In distinction, Bitcoin (BTC) has had a stellar 2024, hitting a number of ATH and commanding a market lid that’s virtually six occasions greater than eth.

Kobeissi’s letter attributes the present efficiency of the mediocre worth of ETH to the potential “market manipulation, innocent cryptocurrencies, to Ethereum’s bearish views.” Nonetheless, the market commentator signifies that this extreme bearish perspective can put together ETH for a quick squeeze. Add:

This excessive positioning implies that the large swings reminiscent of February 3 will probably be extra frequent. Because the starting of 2024, Bitcoin has elevated ~ 12 occasions greater than Ethereum. Is a quick compression set to shut this hole?

Eth Transient compression to begin the excessive season?

A short squeery about ETH may Telethransport Its worth at $ 3,000, and even $ 4,000. Nonetheless, in accordance For the skilled cryptographic analyst Ali Martínez, ETH should defend the help stage of $ 2,600 to rise greater.

Current studies point out that ETH has been probably within the backgroundracing the best way for an upward development funding. One other Steno Analysis report strategies ETH is prone to exceed BTC in 2025, with potential goals of as much as $ 8,000.

That stated, there are nonetheless issues in regards to the Ethereum Basis frequently dumping Eth. On the time of publication, ETH is traded at $ 2,661, 0.1% extra within the final 24 hours.

Unspash’s outstanding picture, X and TrainingView.com graphics