Ethereum skilled a speedy enhance this week and briefly broke vital resistance. Nevertheless it lacked sufficient momentum and regarded like a mistaken breakout.

If ETH faces a deeper rejection on the present degree, a cheaper price could final.

Technical evaluation

By Shayan

Day by day chart

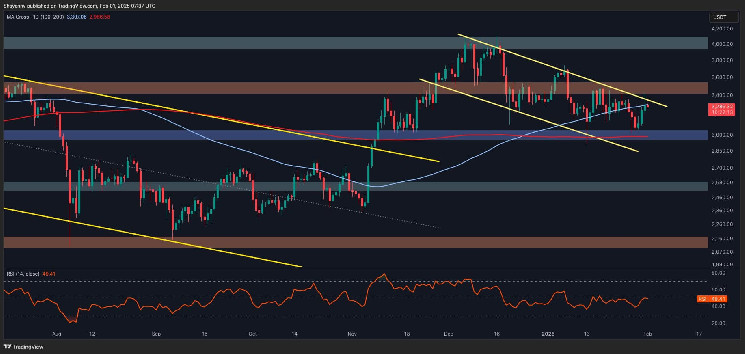

Ethernereum has demonstrated a powerful propulsion from consumers throughout the 3K $ 3K assist vary, barely increased than the resistance space. This vital space consists of the next:

- The common motion for 100 days is $ 3.3,33,000

- The higher restrict of the bullish flag is $ 3.4,34,000

Regardless of the clearing of those ranges, ETH encountered a big gross sales strain of $ 3.5,000 and emphasised inadequate buying energy. This mistaken breakout causes considerations about potential rejection.

If the property exceed these vital values, and in the end regain the overall of $ 3.5,000, they are going to proceed to be bullish. In any other case, refusal can result in a rising volatility and a possible decline.

4 -hour chart

In a decrease time-frame, ETH jumped again from the 0.5-0.618 Fibonacci Retting Zone, then gained momentum and succeeded in exceeding the descending wedge sample. Such breakouts usually point out potential bullish continuation and alter feelings which might be advantageous to consumers.

Nonetheless, after reaching a resistance of $ 3,55,000, Ethereum encountered appreciable gross sales strain and precipitated retraces to the damaged development line earlier than the wedge.

Future value motion is vital. If EtherEum finds assist on this development line and pullback is accomplished, the bullish construction stays as it’s, which might result in one other push to $ 3.5,000. Conversely, if the demand is weak and the consumers don’t intervene, the market could face deeper corrections, and doubtlessly goal the $ 3k assist degree once more.

Ocheen evaluation

By Shayan

Binance liquidation warmth map offers worthwhile insights in fields which might be prone to have substantial clearing occasions. As a result of liquidity tends to operate as a value magnet, these ranges are sometimes the main focus of market actions, and merchants are attempting to make the most of fluid sweep.

A current integration of the market has fashioned a significant cluster at a liquidation degree simply above the vital $ 3.5,000 resistance. These ranges are suitable with the liquidation ranges of weaknesses and are enticing targets for bulls and establishments consumers. Contemplating this setup, Etherneum costs are drawn to this fluid pocket and usually tend to exceed $ 3.5,000 within the center.

Regardless of the dearth of present sturdy bullish momentum, the $ 3.5,000 degree stays an vital battlefield. The decisive motion that exceeds this resistance to set off a brief liquidation could operate as a possible catalyst that may additional promote Ethereum for a psychological $ 4K mark sooner or later session. There’s.