Ethereum (ETH) is engaged on a declining decline as a consequence of its current makes an attempt than the vital resistance zone. The ETH token traded for $ 3,119 is caught in a fragile built-in section that may decide the following giant motion with a 100 -day easy switch common (SMA) of $ 3,312.

1 day chart evaluation

In line with each day chart evaluation, a outstanding effort was paid to interrupt by way of the three,500 -dollar resistance degree of essential technical elements. To this, the higher restrict of the symmetrical triangle sample and the 50 % fibonacci retransement degree have been $ 3,517. Nevertheless, the push was crammed with extreme gross sales strain, pressured to retreat, and beef couldn’t use the momentum.

The unable to keep up the exceeding Ethereum’s main resistance ranges, revealing the weakening of the acquisition strain, inflicting modifications to about $ 3,119 on the present degree. At present, the $ 3,000 help degree is a vital protection line and offers stability because the strain of the bear is rising.

Nevertheless, if this help is damaged, the cryptocurrency will additional lower to $ 2,927, an essential Fibonacci retrospective zone that may perform as an essential battlefield between the Bulls and the bear. Such failures could strengthen the weak and feelings, push ETH tokens into deeper corrections, and reconstruct the trajectory of quick -term market.

The benefit is that the 100 -day shifting common (MA) features as a horrible resistance, and so long as the ETH cryptocurrency is traded underneath it, it suppresses the tips of bullish restoration. Alternatively, the constitutional triangle sample of the chart provides a component of suspense and suggests a pointy and decisive motion in each instructions.

Breakouts over $ 3,500 can relapse optimism and open the door to greater worth objectives. Nevertheless, violations beneath $ 3,000 can speed up the gross sales strain, depart the bull in protection, help the bears and stability. Because the Ethereum token is a vital time, the following motion could outline a right away market outlook to keep up the dealer.

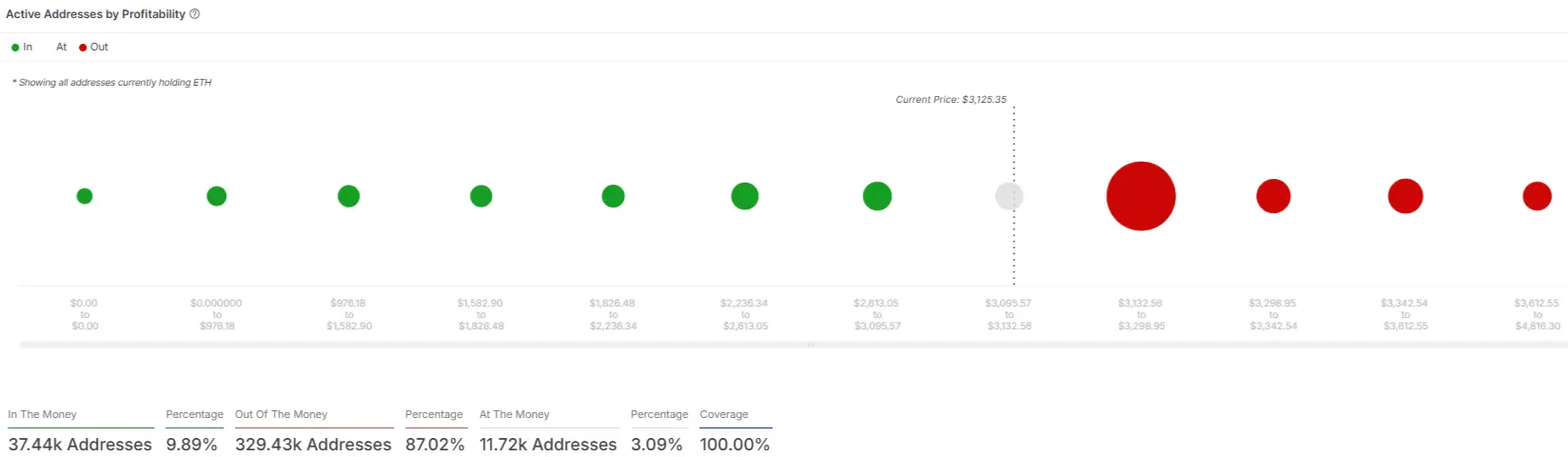

Profitability and buying and selling evaluation

The present worth degree of Ethereum is about $ 3,119, drawing complicated photos for merchants and traders. In line with Worthwhile chart87.02 % of the handle holding the ETH token is “out of cash”, indicating that almost all homeowners have skilled unreasonable losses on the present worth.

Solely 9.89 % of the handle is “cash”, indicating a steep uphill battle for bulls to regain their momentum. Alternatively, 3.09 % of the handle is “cash” and displays the fragile equilibrium of the market. This strict disparity emphasizes the significance of the $ 3,000 help zone. The failure can strengthen the weak sentiment and promote costs towards the following essential Fibonacci retransement degree of $ 2,927.

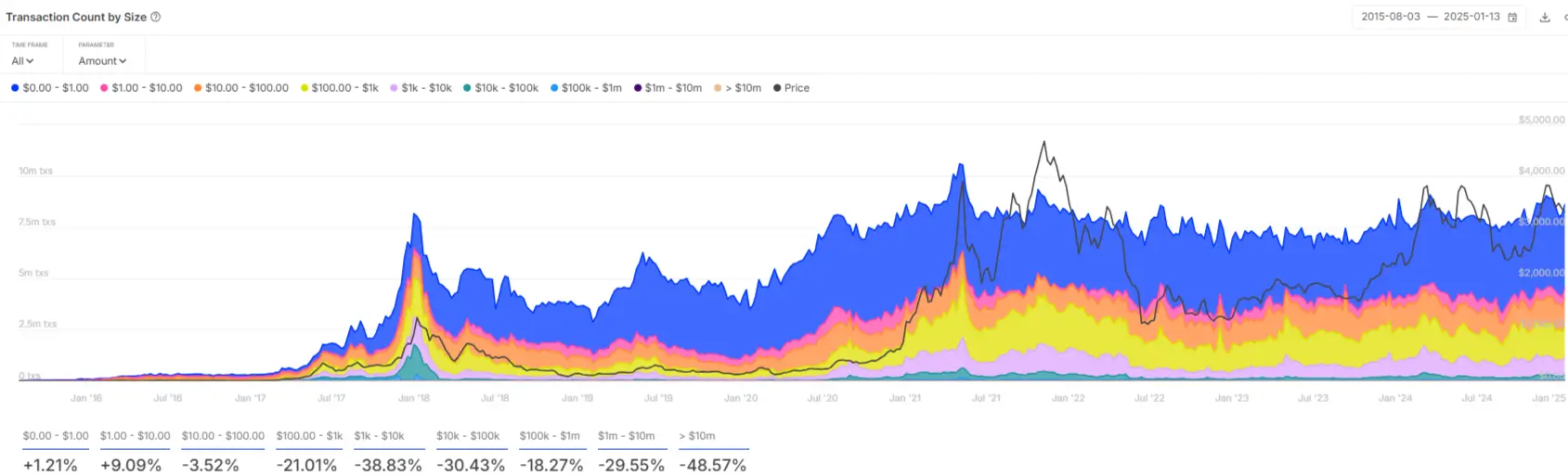

Conversely, a decisive push that exceeds $ 3,132 to $ 3,500 can present a really essential aid for struggling traders. then again, Transaction depend knowledge For every dimension, additional insights on market habits turn out to be clear. A small transaction of lower than $ 1,000 has a slight development, and the transaction of lower than $ 1 and the $ 1 to 10 {dollars} has elevated +1.21 %, +9.09 %, respectively.

Nevertheless, giant transactions are reducing quickly. for instance:

- Transactions from $ 10,000 to $ 100,000 decreased -30.43 %.

- Transactions from $ 10 million to $ 10 million have plummeted -29.5 %.

- Greater than $ 10 million, buying and selling on an institution-scale was the most important hit and decreased -48.57 %.

This downward development of huge -scale transactions means that confidence amongst institutional gamers has declined and additional examined the quick -term outlook on cryptocurrencies.

Learn once more: AAVE PRICE goals for $ 400 as a result of the exercise of whales is rising quickly.