As of January 29, 2025, Bitcoin is traded for $ 102,785 and has been hovering inside $ 100, 272 to $ 103,053. The market capitalization of the cryptocurrency is $ 2.02 trillion, and the day by day transaction quantity is supported by $ 35.55 billion.

Bitcoin

Bitcoin’s wider vary stays bullish, however the integration of almost $ 102,000 displays the eye between merchants, and the quick help and quick help of $ 104,000 to 105,000 are $ 100,000 to 101,000. The subsequent route of the market is dependent upon whether or not the customer maintains the momentum or the Bears compelled a retreat.

The important thing rator attracts a picture combined from impartial. 53.3 relative energy index (RSI) and 42.5 chance index suggests an equilibrium, and the shifting common convergence (MACD) indicators 1,466.6 weak point components. The momentum stays bullish at 730.0.

The shifting common (MAS) reveals a contradictory sign: the short-term index switch common (EMA-10) and the easy shifting common (SMA-10) are bought at 102,407.2 and $ 103,37.0, respectively. Lengthy -term EMA and SMA (20-200) unanimously help purchases and strengthen the fundamental highly effective energy.

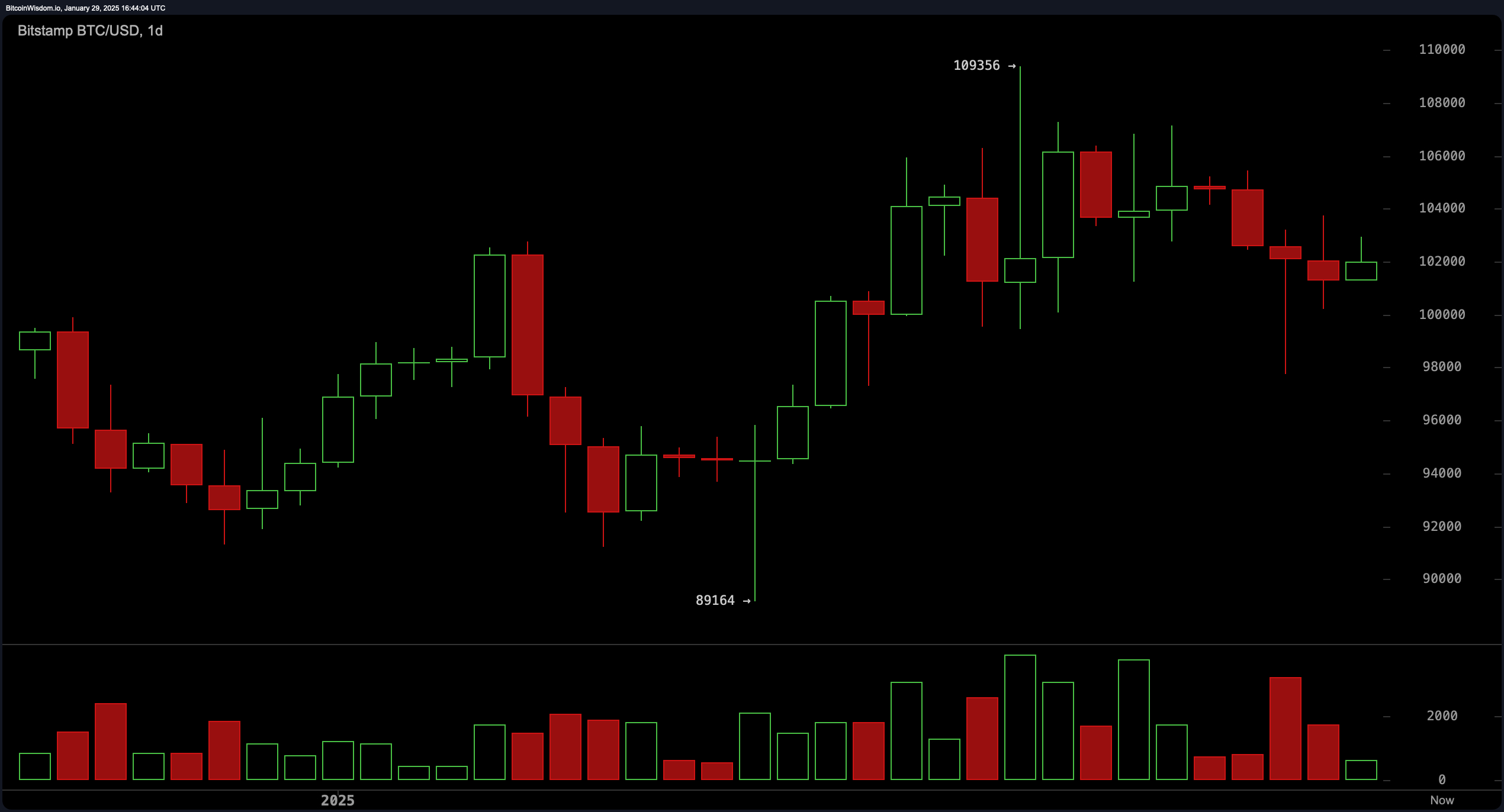

Bitcoin’s day by day chart exhibits that Bitcoin is a $ 109,356 peak from $ 89,164, and is presently built-in between $ 102,000 and $ 104,000. The resistance is $ 109,000 to 110,000, supporting the $ 97,500-98,000 macro outlook. Closed from $ 100,000 to $ 102,000 could promote a 107,000-109,000 -dollar re -test.

BTC/USD 1D chart through BITSTAMP on January 29, 2025.

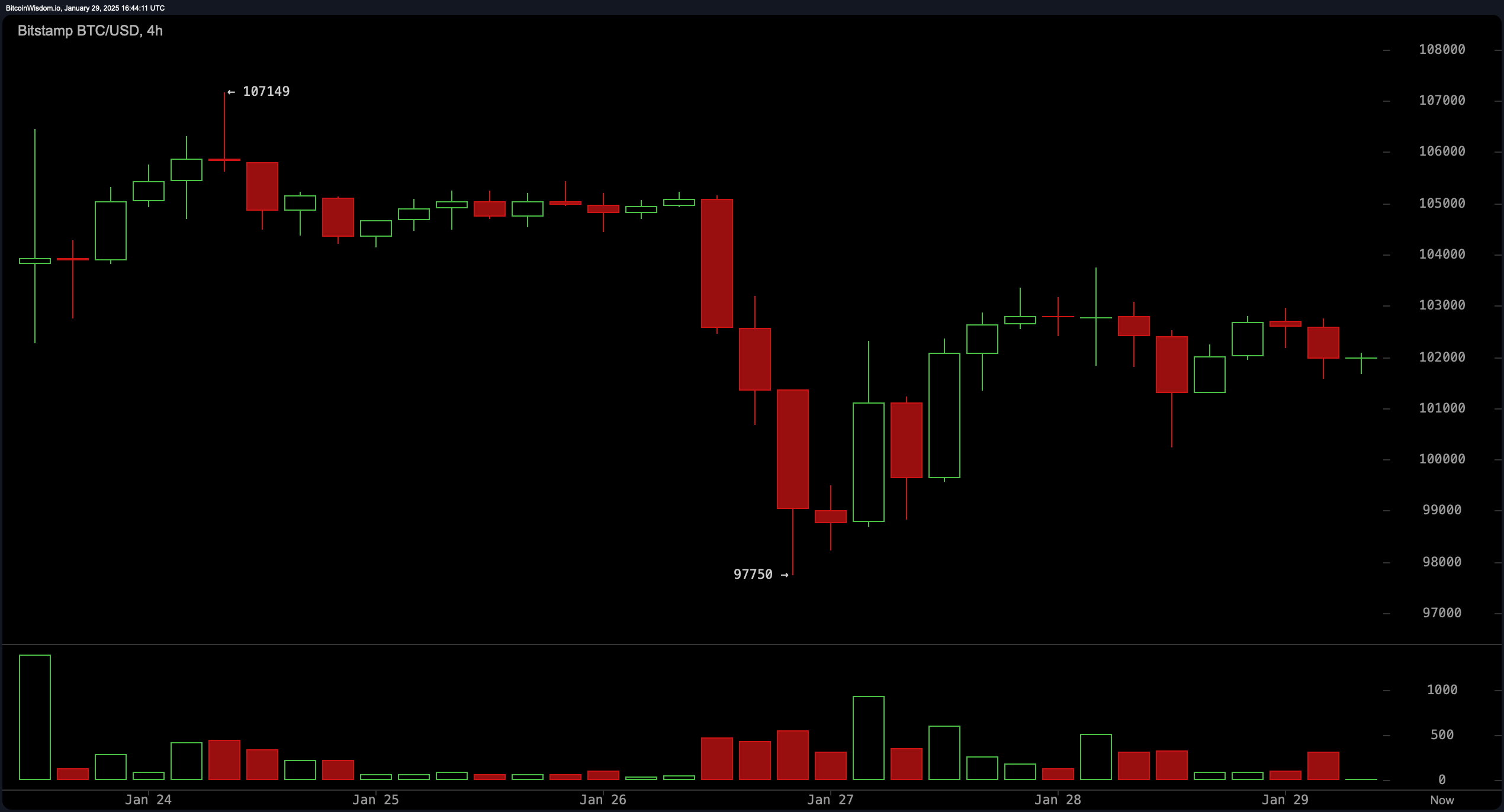

Conversely, a drop beneath $ 100,000 dangers retreat to $ 97,500-98,000. The rise in quantity at a current excessive worth emphasizes the responsible of the customer, but when you don’t violate $ 104,000, you could be invited. The 4 -hour chart has revealed the restoration of $ 97,750, and the resistance is hardened at $ 104,000 to 105,000. Merchants will see a protracted entry of $ 100,000 to $ 101,000 or a brief setup of $ 104,000 to $ 105,000.

BTC/USD 4H chart through BITSTAMP on January 29, 2025.

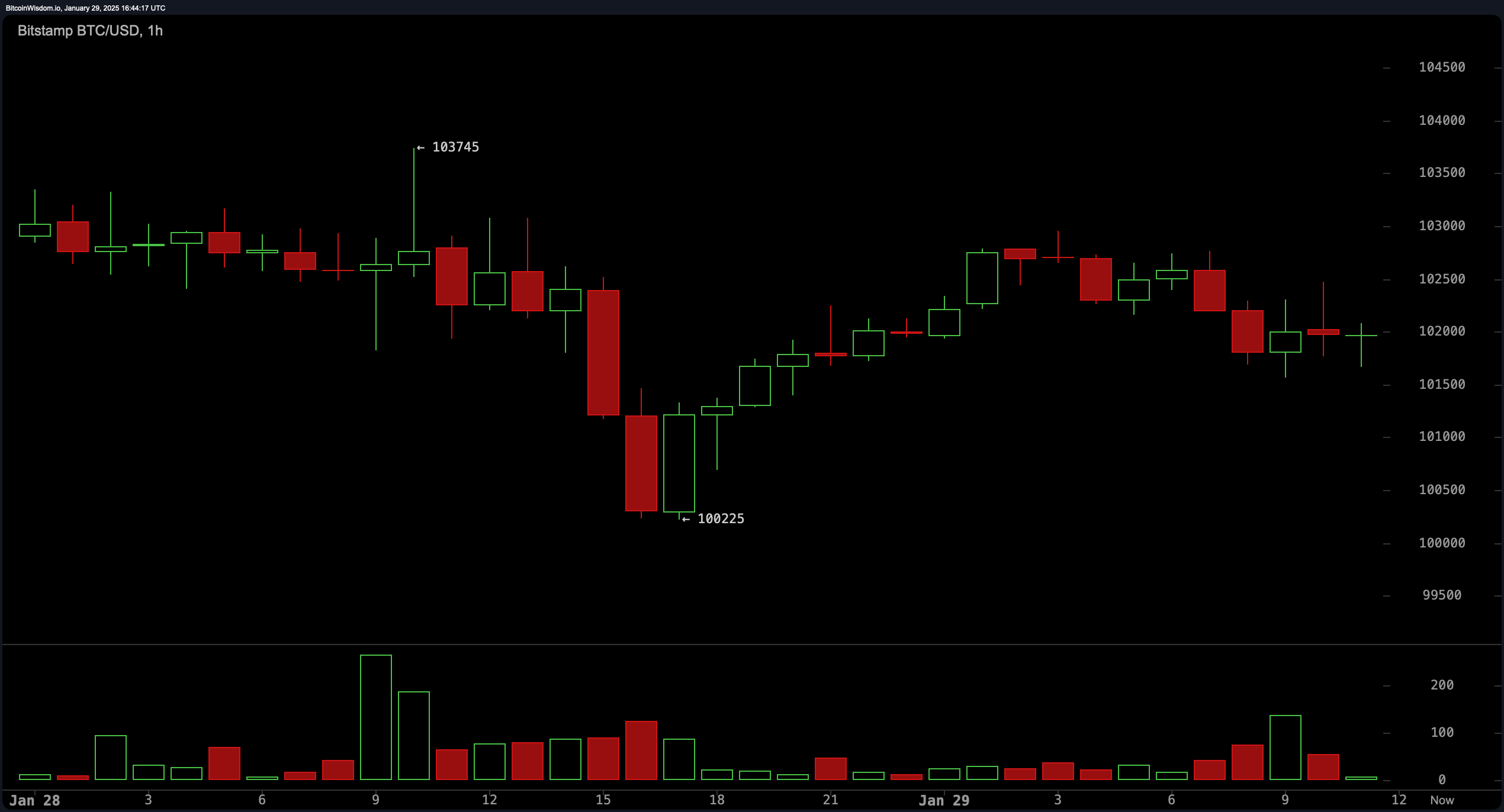

The one -hour chart signifies an interrupted motion of about $ 102,000, and the daytime scalping alternative is $ 101,000 to 101,500 (bought) from $ 103,500 to 104,000 (brief). It is very important notice that the amount of each hour is low, however breakouts that exceed $ 104,000 could cause momentum towards larger targets.

BTC/USD 1H chart through BITSTAMP on January 29, 2025.

Bull overview:

Bitcoin’s bullish instances exceed the lengthy -term shifting common (index switch common (EMA) 20-200 and easy motion common (SMA) 20-200). It is dependent upon the flexibility. 。 Breakouts exceeding $ 104,000 to $ 105,000 can goal the 107,000-109,000 -dollar reassemble to revive the customer’s curiosity. The day by day quantity and bullish momentum at 730.0 will improve the opportunity of persevering with upwards except the $ 99,000 stoploss stage continues to be dependent.

Bear overview:

If bitcoin doesn’t violate the resistance of $ 104,000 to 105,000, the bearish state of affairs positive factors traction, and the short-term gross sales sign from the exponential switch common (EMA-10) is $ 102,407.2, and the typical motion common of 1,466.6. It means that the convergence department (MACD) is weakened. Failures beneath $ 100,000 could cause cascade to $ 97,500-98,000 help. Merchants want to watch the rejection on the primary stage and put together a deeper correction if the vendor controls the brief -term construction.