Bitcoin (BTC) is turning into harder to extract after rising competitors within the final ten days. The next problem adjustment could make the community much more aggressive.

The Bitcoin problem (BTC) index is near a historic most, after a small readjustment on the finish of January. The next problem for readjustment factors to a rise in 4.71%urgent much more to miners to assign extra assets or shut their operations to anticipate extra favorable problem situations. The conduct of miners and their preparation to provide cash in all situations can droop whether or not the BTC value will proceed its upward stroll or face extra gross sales stress.

In current days, the sustainability metric of mining losses/positive aspects modified to ‘poorly paid’, based mostly on cryptocant information. Since 2022, the miners had poorly paid durations of mining, which didn’t forestall them from constructing extra information facilities. Nonetheless, this additionally meant that miners have been strategic about their sale, attempting to take advantage of the native market tops.

The Bitcoin mining capitulation idea has already been examined in 4 halvings. All through the historical past of Bitcoin, the miners haven’t deserted the community, nor have they led to the stagnation of block manufacturing. Nonetheless, past a sure level, miners can speed up their sale and exert extra stress on the worth of BTC.

The impact of mining capitulation can remove inefficient miners, which results in the substitute of apparatus and a brand new steadiness of blocks and block rewards. The value for problem is at present in a transition zone, the place miners can proceed to stretch their efforts for some time, however can quickly change on the market.

Bitcoin Mining remains to be aggressive for bigger operations

Simply earlier than the readjustment of problem, mining charges elevated once more to greater than 992 eh/s. Massive swimming pools and mining operations confirmed no indicators of lowering their makes an attempt to unravel blocks. Nonetheless, some miners proceed to compete even when the doable revenue margins are small.

The following problem adjustment can result in a slower mining interval, in an try and create extra favorable situations. Nonetheless, some mining operations can even attempt to inflate the hashrate and make much less aggressive mining amenities capitulated.

Bitcoin common Mining prices They’re $ 86,000, whereas BTC quoted above $ 97,000. The impact of mining problem can be totally different for varied solo mining information facilities and facilities. Even now, whale miners can afford to retain extra of their cash, whereas small -scale operations are bought quicker.

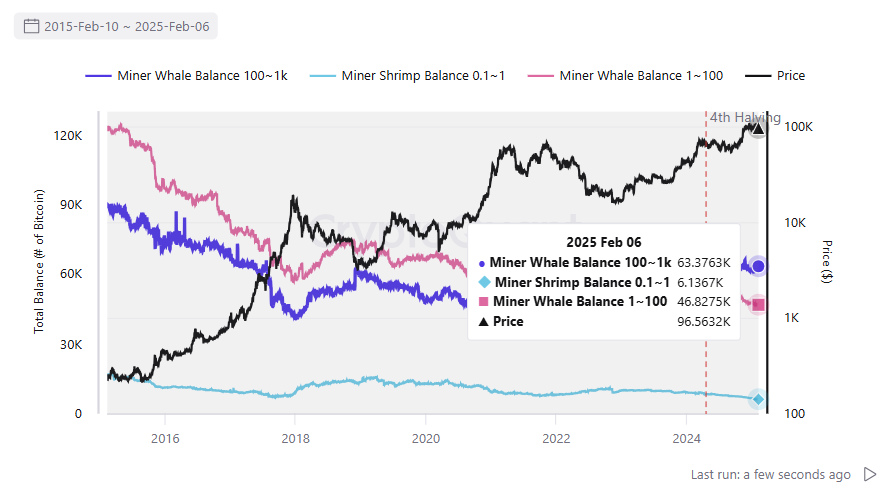

Small -scale miners are bought quicker, whereas whale operations could be allowed to have BTC. | Supply: Cryptoquant

The development of shrimp and small -scale miners bought within the final days of 2024, when BTC made its stroll above $ 100,000.

Will mining capitulation trigger a value fund?

Miners sustain 1.91m Cash, with every day fluctuations for promoting and new manufacturing. The choice to promote throughout a capitulation occasion will exhaust gathered reserves through the earlier half durations.

A miners capitulation occasion, even when it’s not dramatic, can point out the top of a market discount. The present indicators of miners decelerate their exercise and the sale can translate right into a BTC buy signal Within the coming weeks.

BTC has already handed a small capitulation occasion in the summertime of 2024, adopted by the same historic buy sign. Mining behaviors are thought-about comparatively predictable, and a approach of measuring the way in which to comply with for the acquisition of spot cash.

In early 2025, BTC nonetheless had a comparatively profitable efficiency in January. For some miners, the bills for mining an extra BTC have been even decrease than the market value, whereas providing a future worth within the case of a present upward market in 2025.

Regardless of the mixture of difficult mining situations, BTC isn’t but blinking a hash tape indicator. The looks of a HASH tape signifies the energetic section of mining capitulation, the place situations actually trigger a gross sales spherical.

For the final time, a brief capitulation signal It appeared in October 2024, instantly compensated by the top of the yr rally. The looks of a hash tape additionally coincides with durations of extra dramatic market. Nonetheless, the mining capitulation interval can be an indicator that the discount has ended and an area decline has been discovered. After that, each retailers and miners return to steadiness and may start a brand new bullish cycle.