Bitcoin could have lately reached a neighborhood background, in keeping with the HASH tape indicator.

Amid latest macroeconomic uncertaintyHypothesis has continued to extend if Bitcoin It has been overcome. In line with a key metric, nonetheless, it could possibly be the other.

Finish of miner capitulation

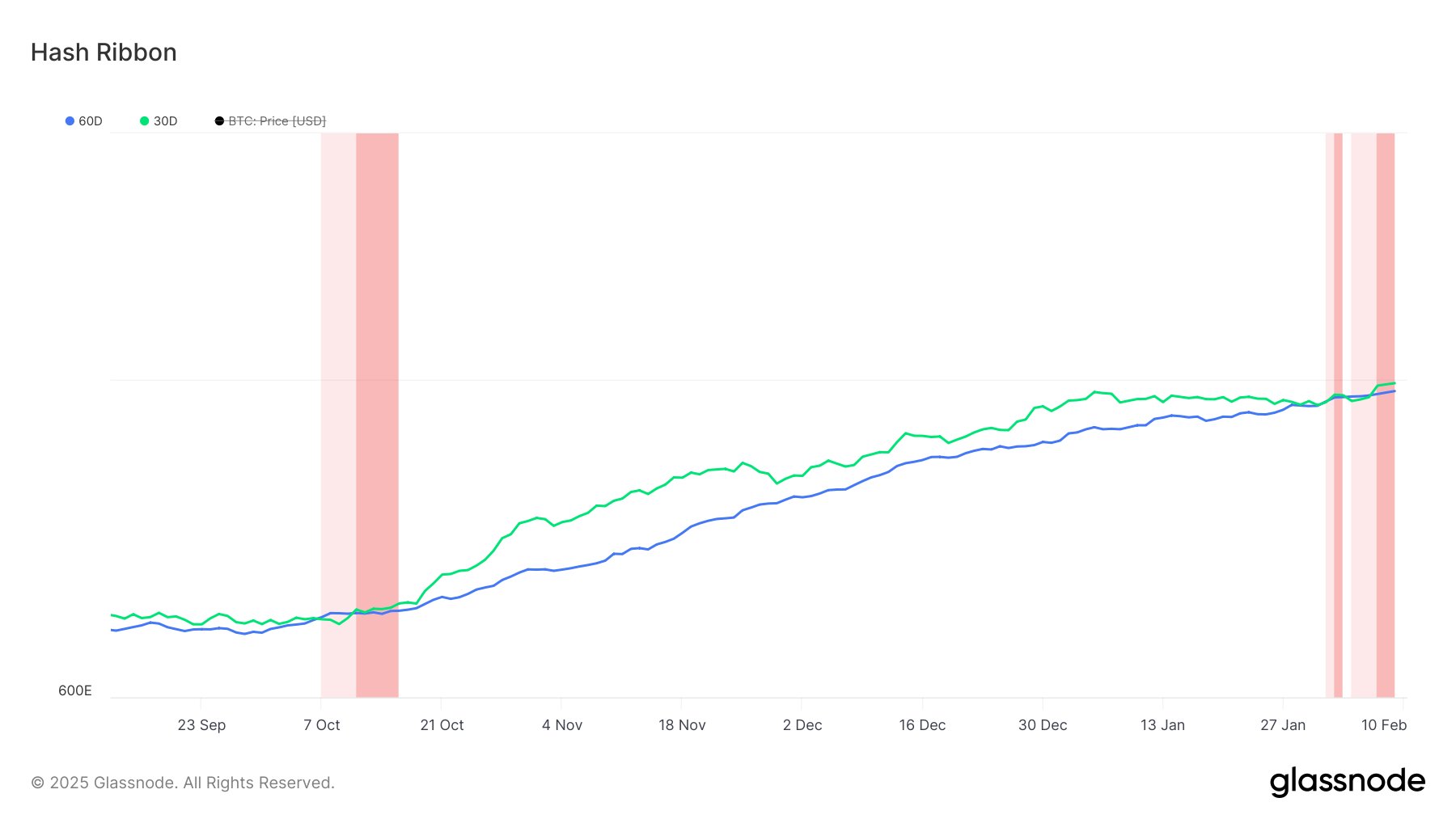

Bitcoin could have lately reached a neighborhood background, in keeping with the HASH tape indicator.

The hash tape indicator assumes that Bitcoin tends to succeed in a neighborhood background when the miners capitulate: it sells their Bitcoin holdings to remain afloat or shut as mining prices improve above profitability. This typically happens when the value of the asset decreases or the working prices improve.

The indicator gives Bitcoin buy indicators when making an attempt to determine the phases on this capitulation utilizing the cellular common of the 30 and 60 -day hash fee.

The HASH fee refers back to the pc energy utilized by Bitcoin miners. This metric usually will increase when extra miners be a part of the community or increase operations, typically pushed by a rise within the worth of the asset. Then again, the hash fee falls when miners shut as profitability falls.

When the cellular common of the 30 -day hash fee beneath the 60 -day cellular common, that’s, the common lowest hash fee tendencies within the quick time period as a result of the miners shut, it’s believed that the capitulation of The miners started, which induces the gross sales stress.

Then again, when the 30 -day MA is minimize above the 60 -day MA, it usually signifies the tip of the worst of the miner capitulation, marking the lowered gross sales stress and the opportunity of a rebound.

In line with the desk, this capitulation started in early February 2025 and doubtless offered out in the course of the weekend. The final time he did it in October 2024, Bitcoin began a rally of greater than 50% from beneath the $ 70,000 to $ 106,000 days later.

Bitcoin Hash Glass supply tape indicator

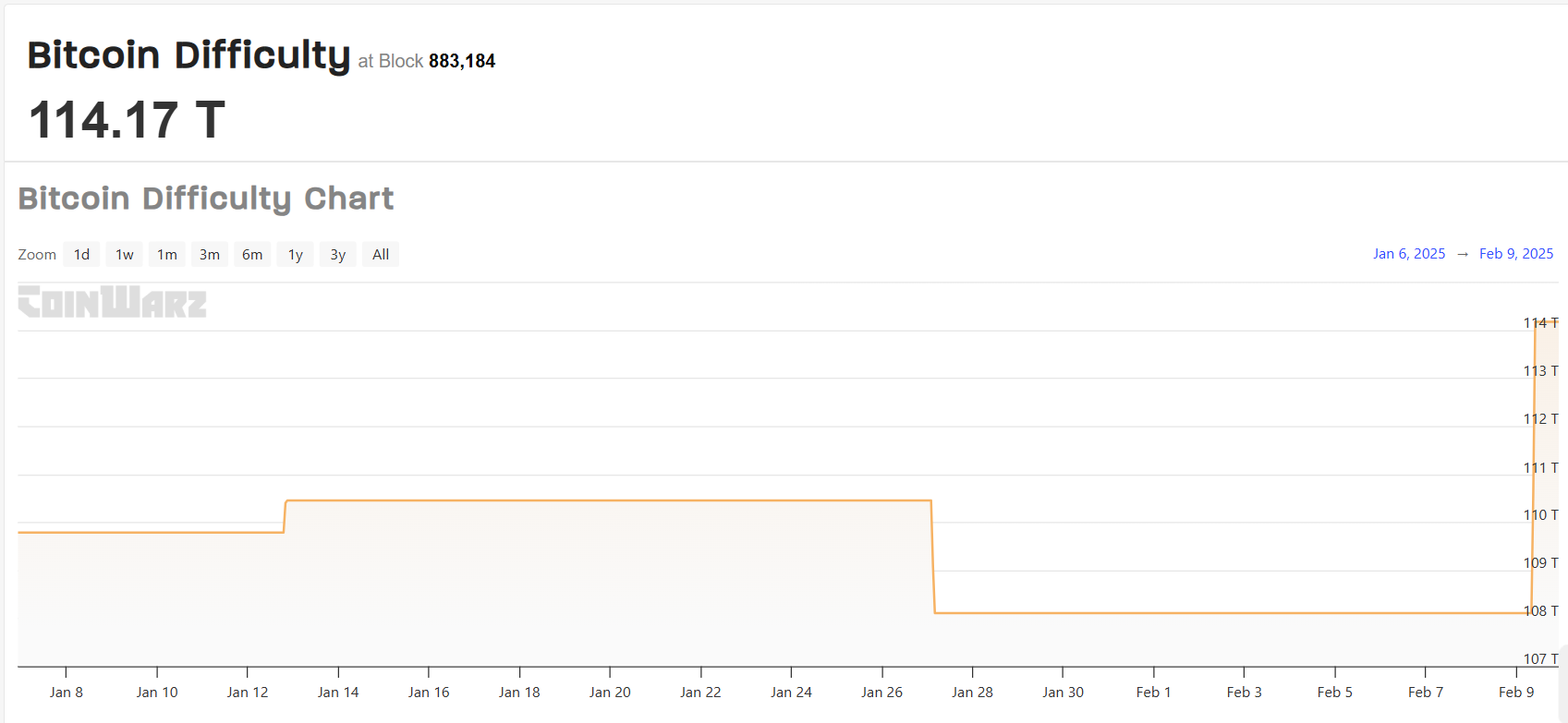

Apparently, the latest miners capitulation sign is aligned with a brand new registration of mining issue. For the context, the mining issue measures how troublesome it’s to extract a brand new block within the block chain in comparison with the baseline in 2009.

Community individuals typically see a rise in metric as constructive for the asset and indicative of higher community security and well being.

On Sunday, February 9, the metric elevated 5.6% from 108.11 billion to succeed in a brand new historic most of 114.17 billion in block 883,008, which means that it’s now 114 billion occasions harder to extract a block within the community in comparison with the primary. launched, by Coinwarz information.

Bitcoin Mining Issue Supply of the Coinwarz Desk

The mining issue adjusts each 2,016 blocks, and the next adjustment is predicted to be 0.33% larger at 114.55 billion in block 885.024 on Sunday, February 23.

Within the midst of those adjustments in chain metrics, Bitcoin quote about $ 97,500 on the time of writing. If these constructive metrics set off a positive worth response, Bitcoin might once more level to the psychological model of $ 100,000.