A handful of UK-listed firms have taken contemporary steps to tie their steadiness sheets extra carefully to Bitcoin. Strikes vary from making new purchases to routing gold revenues and even opening retail crypto buying and selling on the London Inventory Trade. The developments present rising company curiosity in holding and buying and selling digital property alongside extra conventional operations.

Smarter Net Boosts Bitcoin Stash

In response to firm filings, The Smarter Net Firm added 45.32 BTC this month, spending $4.73 million. Its whole hoard now stands at 168 BTC. That marks an over 55% bounce from its earlier purchase. The agency first rolled out its “10 Yr Plan” in April as a technique to construct up a long-term treasury.

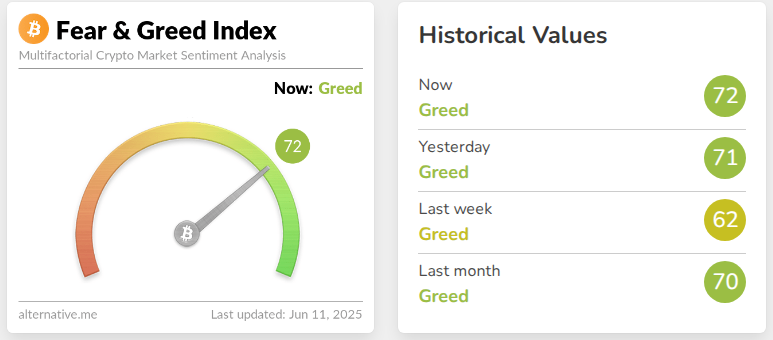

Supply: Different.me

Primarily based on reviews, it has invested almost $18 million to date, shopping for Bitcoin at a median of $105,779 every. Shopping for when the market’s Greed index hit 72 reveals they’re keen to carry via ups and downs.

The Smarter Net Firm (#SWC) RNS Announcement: Bitcoin Buy.

Buy of extra Bitcoin as a part of “The ten Yr Plan” which incorporates an ongoing treasury coverage of buying Bitcoin.

Please learn the RNS on our web site: https://t.co/z59Xf4oBRU pic.twitter.com/vmtFzjsQeY

— The Smarter Net Firm (@smarterwebuk) June 10, 2025

Mining Agency Converts Gold Gross sales

Bluebird Mining Ventures Ltd, recognized for its gold operations, stated it can funnel future income immediately into Bitcoin. The miner goals to turn out to be the primary UK-listed gold firm with a totally BTC-focused treasury technique. It made the choice after Bitcoin climbed to a file excessive of $111,965 in Could.

Administration sees this as a retailer of worth alongside its mining output. The plan calls for normal conversions as earnings grows, betting that Bitcoin good points will outpace conventional reserves.

Buying and selling Platform Opens Crypto Doorways

IG Group, a long-standing buying and selling agency on the London Inventory Trade, rolled out a brand new service this week. Retail purchasers can now purchase and promote Bitcoin, Ethereum, and Ripple straight via IG’s regulated platform.

Beforehand, traders had to make use of ETFs or third-party wallets. The change means IG can faucet into rising demand for direct crypto publicity. It additionally positions the agency to earn new payment income as extra merchants flock to its website.

Treasury Development Spreads Amongst Companies

Primarily based on market observers, a number of different British firms are weighing comparable strikes. Capital-heavy companies are speaking about setting apart funds for Bitcoin. Some view it as a buffer towards inflation. Others merely don’t wish to miss out if costs climb additional.

Whereas company treasurers have been as soon as cautious, the regular drumbeat of excessive crypto returns has pushed extra boards to at the very least focus on pilot packages.

Taken collectively, these actions counsel that digital property are now not fringe experiments for large firms. They’re turning into a part of mainstream treasury playbooks.

Featured picture from Pexels, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.