A distinguished crypto analyst stated that Bitcoin went via a big occasion over the previous few months because the coin’s open curiosity plummeted by practically 20%, wiping out round $12 billion.

BTC’s open curiosity wipeout would possibly seem like detrimental to the coin, however CryptoQuant analyst DarkFost believes that the cleaning is crucial for a “bullish continuation”, citing that it could present alternatives for its traders within the close to time period if historical past repeats itself.

Bitcoin’s practically $12 billion open curiosity shakeout earlier this month is likely to be simply the catalyst wanted for the asset to regain its upward momentum, in line with a crypto analyst.

A Catalyst

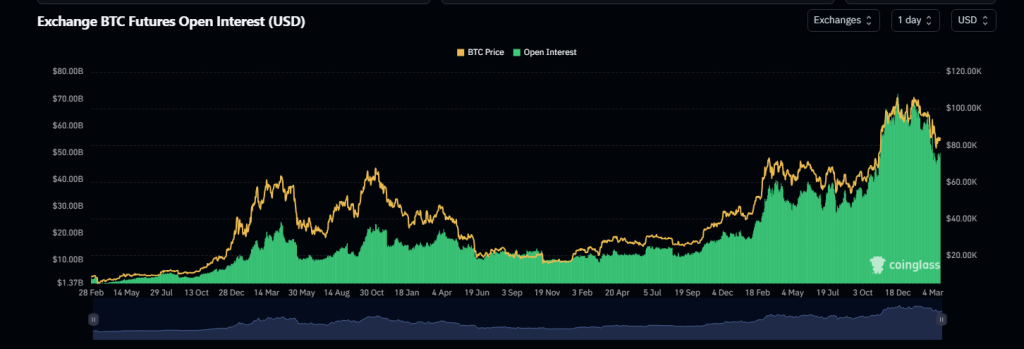

Information from CoinGlass reveals that the firstborn crypto’s open curiosity dropped by 19%, from $61.42 billion to $49.71 billion, citing that the $12-billion shakeout is likely to be a superb factor for Bitcoin.

“Following the current panic triggered by political instability linked to Trump’s selections, we witnessed an enormous liquidation of leveraged positions on Bitcoin,” DarkFost stated.

Supply: Coinglass

The analyst stated greater than $10 billion in open curiosity has been erased in solely two months, with an estimated $10 billion worn out between February 20 and March 4.

DarkFost claimed that the wipeout skilled by BTC earlier this month may function the catalyst wanted by the coin to regain the momentum that can enable the crypto to maneuver upward.

“This may be thought of as a pure market reset, an important part for sustaining a bullish continuation,” the analyst defined.

Good Alternatives

DarkFost recommended that the current ordeal confronted by Bitcoin would possibly show to be advantageous to the crypto within the subsequent few months.

The analyst offered a chart that reveals the reset phases by figuring out the moments when the 90-day open curiosity change turns unfavourable, including that the present 90-day change in Bitcoin futures open curiosity plummeted and is now sitting at -14%.

“ historic developments, every previous deleveraging like this has offered good alternatives for the quick to medium time period,” the analyst added.

Affect Of The Federal Reserve

Some specialists stated that the Federal Reserve’s actions would possibly have an effect on what is going to occur subsequent to Bitcoin.

At the moment’s assembly of the Federal Open Market Committee may add extra volatility to the crypto if there’s something sudden within the financial coverage.

Bitget chief analyst Ryan Lee defined that Bitcoin is already hovering on the $80,000 stage and extra volatility is likely to be anticipated within the coin’s value and open curiosity if the March 19 Federal Open Market Committee assembly delivers any surprises.

“The market largely expects the Fed to carry charges regular, however any sudden hawkish alerts may put stress on Bitcoin and different danger belongings,” Lee stated.

As of press time, Bitcoin’s open curiosity stood at $49.02 billion, which is roughly a 6.5% improve over the previous 5 days.

Featured picture from The Unbiased, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.