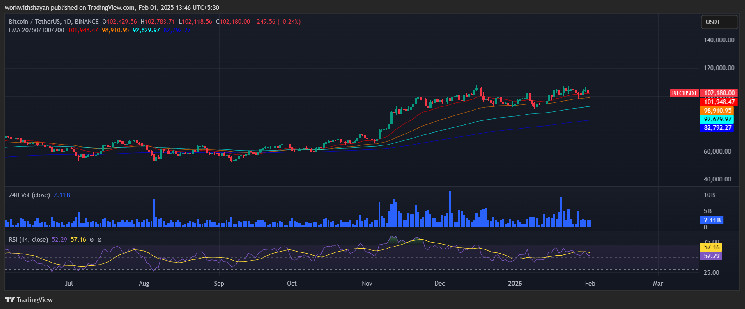

Bitcoin costs present indicators of weakening momentum, elevating questions on potential buy alternatives and market course. Analyst Ali Martinez means that merchants might wish to watch for a greater entry level earlier than making a giant funding.

Traditionally, the very best shopping for alternatives seem after a dealer experiences a 12% loss. Nevertheless, present indicators present that they’re nonetheless worthwhile. Moreover, the shift to momentum in Bitcoin’s market worth realising worth (MVRV) has traditionally marked an necessary turning level, suggesting warning within the brief time period.

One of the best shopping for alternative for #BitCoin $BTC happens traditionally when merchants are struggling a lack of -12%. Now they’re nonetheless sitting with a revenue of 0.21%. pic.twitter.com/7yp1pmqp9k

– Ali (@Ali_Charts) February 8, 2025

Analyze Bitcoin’s MVRV momentum

Bitcoin’s 180-day MVRV momentum is a crucial indicator used to evaluate market energy. The latest recession of this metric displays earlier cases, which has led to a big worth correction. The damaging momentum section marked within the gray zone of the chart is traditionally per native price-top or bearish traits.

Associated: Bitcoin Guess pays off: Technique₿ (MSTR) surpasses prime inventory

Ali Martinez highlights two necessary pricing ranges to observe. Almost $30,000 assist zone and $40,000 resistance. These ranges might decide the subsequent market motion, as a historic transition in MVRV momentum has occurred inside these ranges. The weak bullish momentum means that traders needs to be cautious about short-term worth actions.

Bitcoin’s present market efficiency

Bitcoin is presently buying and selling at $96,161.11, a worth drop of 1.15% over the previous 24 hours and a 5.69% down over the previous week.

With a market capitalization of round $1.9 trillion and a round provide of 20 million btc, the asset stays the dominant drive within the cryptocurrency market. Regardless of the short-term decline, long-term forecasts are optimistic and count on a big worth enhance earlier than the tip of the 12 months.

Bullish predictions for Bitcoin’s future

Fred Thiel, CEO of Marathon Holdings Inc., predicts that Bitcoin might greater than double its worth by the tip of the 12 months. He expects a worth vary of $150,000 to $200,000, citing elevated demand from institutional traders and elevated demand from a extra favorable regulatory setting.

Associated: Bitcoin exams $100,000 resistance: Can it maintain this stage?

He additionally stated that large-scale Bitcoin gross sales usually result in sturdy interest-buying, with costs regular between $95,000 and $100,000.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.