In response to the most recent on -chain information, Bitcoin community actions have been useless for the previous few months, and blockchain metrics have not too long ago reached a brand new low degree.

Why is Bitcoin community actions falling?

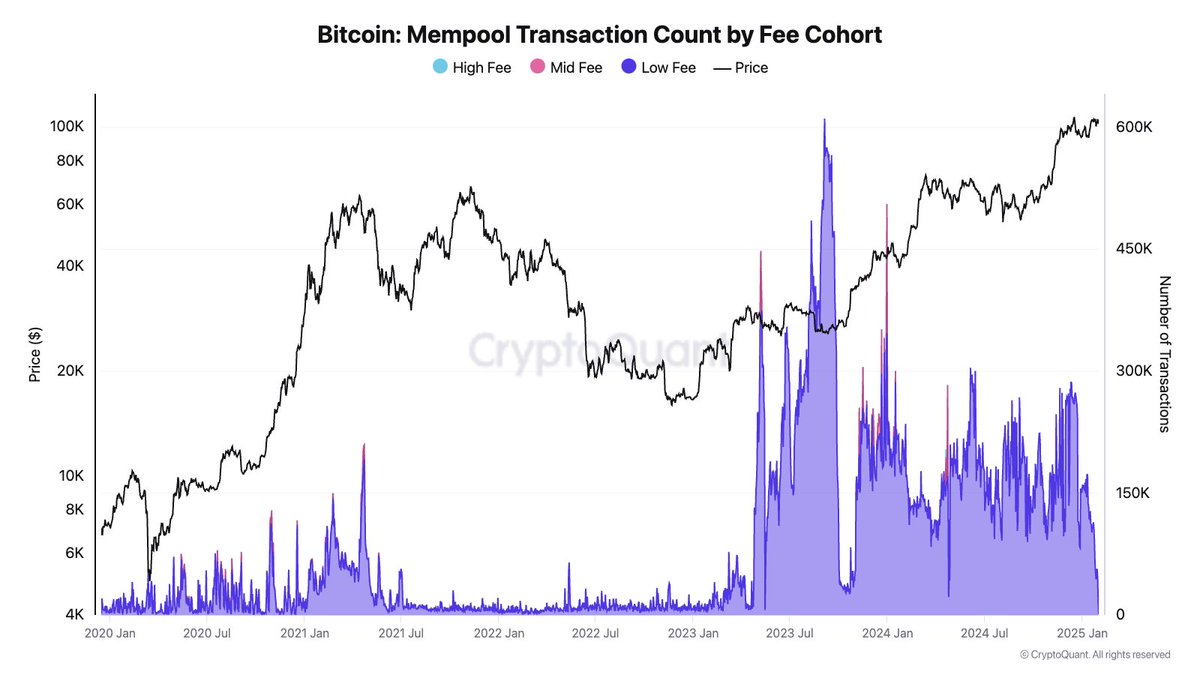

Julio Moreno, head of Cryptoquant Analysis within the new publish on the X platform, mentioned how Bitcoin witnessed an irregular interval of irregular transaction exercise, and Mempool was virtually empty and the transaction price fell to 1 SAT/VB. This represents the bottom degree of community actions since March 2024.

Within the case of context, mempool refers to a short lived storage space through which the withholding bitcoin transaction is ready for processing. Mempool is normally stagnant throughout the improve in chain demand. Nonetheless, in response to the brand new heat chain information, most transactions have been confirmed and the mempool is sort of empty.

Supply: JJCMoreno/X

Virtually empty Memcers are sometimes uncommon within the chain or the change of market epidemiology. In response to Moreno, the primary contributor to this decline is a faint pleasure round Rune and the BRC-20 tokens.

Runes and BRC-20 token requirements are protocols that allow the creation and mining of tokens with out passionate and swearing in Bitcoin blockchain. The protocol acquired appreciable over -advertising on the launch, however the preliminary pleasure was not interpreted as a steady use.

Supply: JJCMoreno/X

Nonetheless, when the rune and the BRC-20 craze reached its peak, the variety of confirmed transactions within the Bitcoin community exceeded 1.5 million units in someday. Particularly, the Pioneer block chain dealt with greater than 1.6 million distinctive transactions between the sender and the receiver on April 23, 2024, and the launch of Bitcoin Rune performed a pivotal position.

The lower within the variety of transactions has a higher impression on the assorted parts of the pioneer blockchain, together with miner income. The miner relies on the transaction price as one other supply of earnings. Specifically, block rewards have been lowered because the latest occasion. Thus, lengthy -term lengthy -terms of low charges can have an effect on mining profitability and doubtlessly have an effect on community hash fare distribution.

Implications for BTC costs

Virtually empty mempool and low buying and selling actions will not be the very best mixture for optimistic costs. Particularly, it may possibly combine Bitcoin costs by low reasoning curiosity and decreasing traders’ ardour.

On the time of this text, the BTC is about $ 100,450 and has decreased virtually 2% over the past 24 hours. In response to Coingeko information, Premier Cryptocurrency has misplaced about 3.5percentof its worth over the past seven days.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Chart of TradingView, the primary picture created by Dall-E