After an explosive breakout that took Bitcoin past the $100,000 mark, the value motion has now settled into a well-known but strategic rhythm of consolidation. As of immediately, Bitcoin is buying and selling round $103,000, and technical evaluation reveals that this section might be the calm earlier than one other important push towards the $106,000 to $110,000 vary.

In keeping with RLinda, a crypto analyst on TradingView, the current consolidation is just not an indication of exhaustion however quite a strategic regrouping for the subsequent leg up.

Bitcoin Value Consolidation Between Key Ranges Constructing Momentum

Bitcoin’s rally from the $97,860 breakout zone to the $104,300 resistance space marked a transparent distribution section, and now the value is hovering between $104,300 and $102,300. It’s simple to see that the value rally slowed down massively previously 48 hours.

Nevertheless, crypto analyst RLinda famous that this range-bound motion is a constructive improvement, pointing to bullish continuation quite than weak spot. A rebound from the decrease finish of this zone, notably from $103,300, $102,300, and even as little as $101,700, might act as a springboard for a breakout try above $104,300.

Notably, the analyst highlighted that this third retest didn’t push the value again as much as resistance, resulting in a neighborhood drop as an alternative. Nevertheless, the ensuing breach of $103,336 reveals that the underlying power remains to be intact. Ought to Bitcoin retest $103,600 efficiently and bounce off the liquidity zone between $102,700 and $102,300, the main cryptocurrency might make one other try at breaking by way of the $104,300 resistance.

If this performs out, the subsequent leg might attain as much as $106,000 and even $107,000, and from there, additional momentum might drive the value above its present all-time excessive of $108,786 up till $110,000 earlier than the tip of Might. Value targets past this degree vary from $120,000 to $180,000 earlier than the tip of the yr.

Chart Picture From TradingView: RLinda

On-Chain Alerts Reinforce Bullish Outlook

This short-term consolidation is not occurring in isolation with promoting strain. Notably, on-chain information and market sentiment assist Bitcoin’s upward path for the remainder of the month.

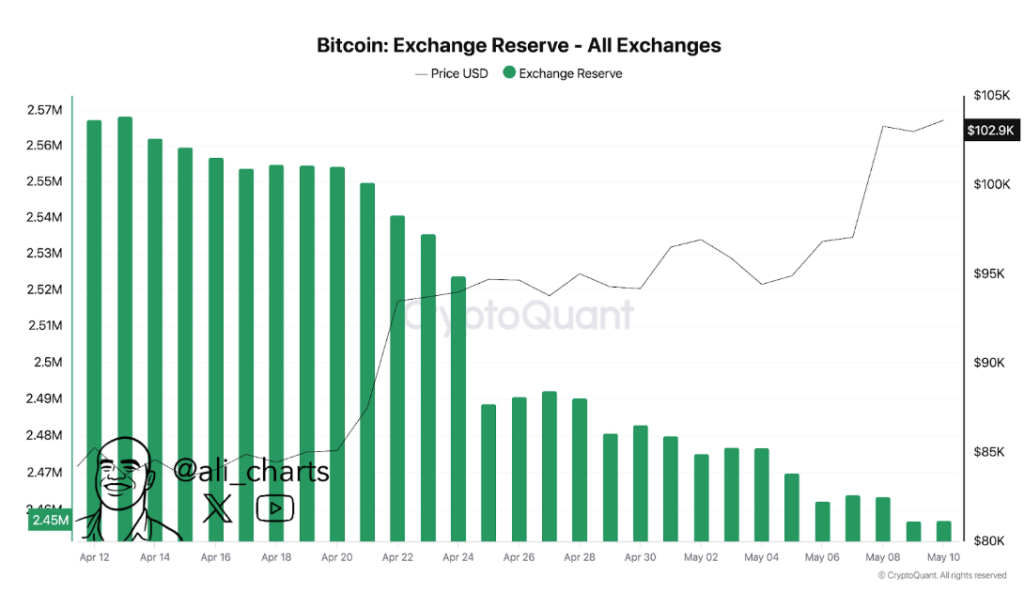

In keeping with crypto analyst Ali Martinez, greater than 110,000 BTC have been withdrawn from centralized exchanges over the previous month. As illustrated within the CryptoQuant chart beneath, this has triggered the overall Bitcoin reserve on crypto exchanges to drop from 2.57 million BTC to 2.45 million BTC.

This can be a signal that buyers are transferring their holdings into chilly storage or making ready for long-term maintain, which reduces speedy promoting strain and helps upward worth motion.

Chart Picture From X: @ali_charts

Proper now, crucial assist ranges to look at are $103,300, $102,300, and $101,700, whereas the resistance ranges to new all-time highs are $104,300 and $108,786.

On the time of writing, Bitcoin was buying and selling at $103,670.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.