Bitcoin (BTC) can be exhausting its OTC reservations accessible on the market, along with Alternate reserves. Extra BTC flows to the wallets which might be much less keen to promote, which results in a provide crunch.

Bitcoin reserves (BTC) in OTC desks proceed to lower after extra outings in current weeks. The one supply of BTC for whales is to expire rapidly, along with the low balances of exchanges. BTC is shifting in the direction of accumulation wallets, which might include extra time and eradicate cash from the open market.

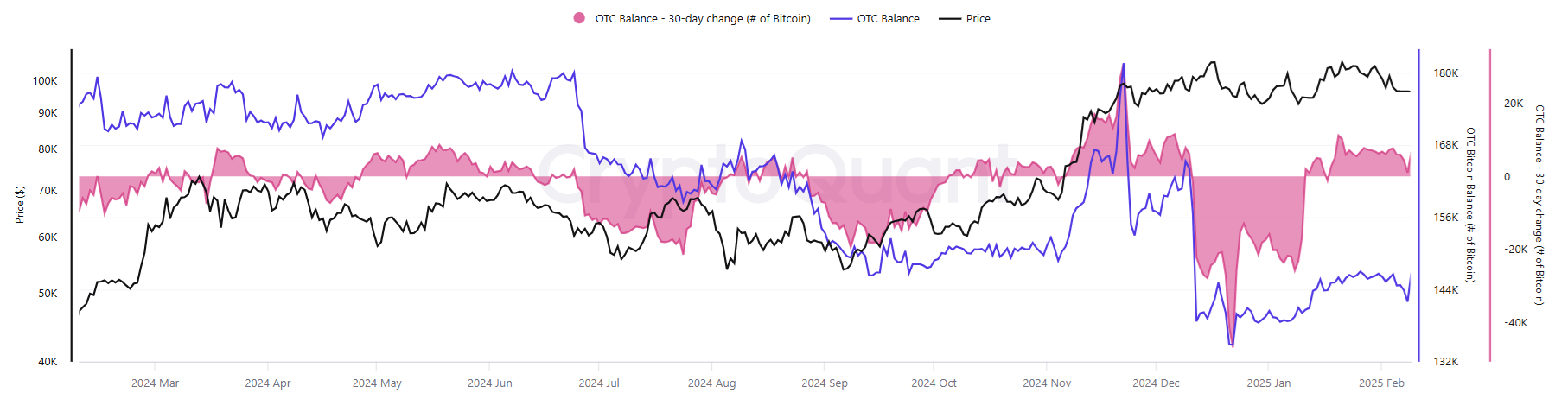

The availability of BTC within the OTC desks is reducing, reviving the narration of a potential provide creak. | Supply: Cryptoquant

The availability narrative remains to be by BTC, particularly after the final half. OTC desk provide It was estimated at round 144k BTC. ETF maintains extra cash, which sees small each day exits, however cling to many of the currencies acquired thus far. The autumn in OTC reserves coincided with one of many best change retreats on February 7. The current market sauce led to a higher accumulation of whales.

Latest knowledge additionally confirmed that the pockets cohort of seven to 10 years moved 14,000 BTC. The cash, acquired in a cheaper price vary, can nonetheless affect the choice of the holders. Nevertheless, even these cash usually are not sufficient to lift the BTC simply accessible. New cohorts of decisive headlines seem, since among the oldest whales start to redistribute their holdings.

Exhausted OTC funds can result in open market buy

BTC was nonetheless round $ 97,000, and not using a important rally based mostly on the eventual provide creak. The BTC area elevated to 58.3% for the reason that asset managed to retain extra worth in comparison with Ethereum (ETH) and Altcoins.

OTC’s demand can come from company consumers, even renewed purchases of Microstrategy. The opposite supply of demand is that market producers, who can purchase cryptographic property by means of OTC desks, then use them in exchanges to have an effect on the market. OTC purchases don’t immediately affect the worth, however point out a number of potential sources of demand.

If OTC reservations are low sufficient, consumers could should resort to the open market to accumulate cash. These agreements would have an effect on the BTC market worth, amplifying by means of the spinoff market.

One of many causes for the OTC Steadiness is the dearth of recent entries. Throughout the 2021 bullish market, OTC desks noticed excessive demand, but additionally tickets through the market peaks. Throughout the 2024 bull cycle, there are solely comparatively smaller OTC tickets, that are purchased quickly. This has taken the final stability to a historic minimal.

BTC’s common demand is slowed down

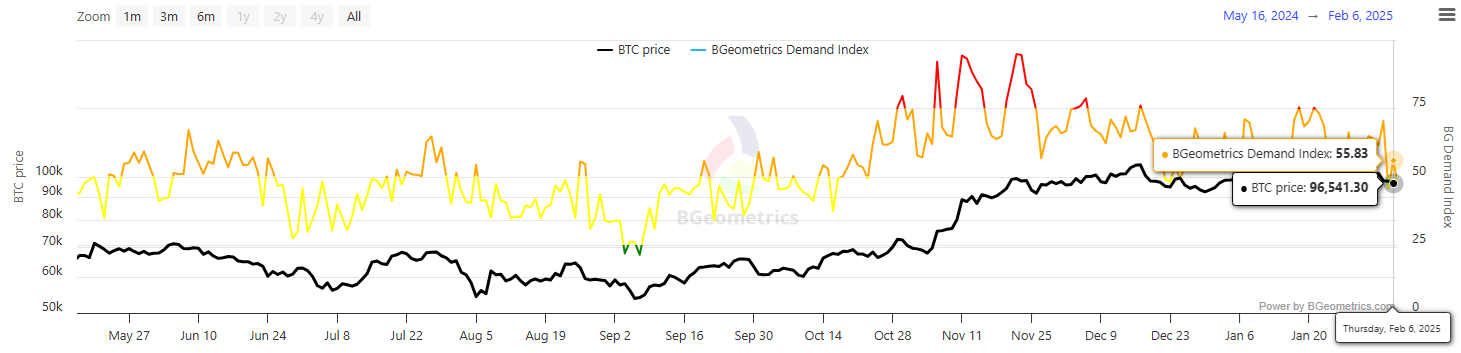

Whereas whales and strategic consumers are nonetheless accumulating, put up -election frenzy for BTC is stress-free. BTC’s demand reached an area peak on November 22, decreasing the most well liked degree since then.

BTC’s demand displays the unemployed commerce after the elections, however the demand remains to be in the next baseline. | Supply: BGEOMETRICS

Within the coming weeks, the demand for BTC can lower to ranges not seen since September 2024. The market has not seen FOMO normally, however each retail commerce and establishments are accumulating tokens extra strategically. Because the demand slowed down, Bitcoin’s worry and greed index rapidly moved down, sinking 43 factors or the “worry” space. Most of February has seen fearful commerce, after a extra optimistic feeling in January.

Throughout current falls, the acquisition of BTC continued, displaying demand for management of actual currencies. On the identical time, BTC opens pursuits for the spinoff commerce, it remained comparatively secure to $ 28b. BTC continues the sample of stirring derived positions, whereas whales accumulate the remaining BTC.

The acquisition of BTC Spot is now slower in comparison with 2023. Derived exchanges nonetheless take the lead, regardless of the sequence of liquidations. On the identical time, the acquisition of spot is attempting to ascertain a restoration, rising the place to the quantity of negotiation derived round 30% In current months.

The impact could also be because of the demand for Coinbase commerce, from American consumers. The US greenback remains to be in cost 20% Of all of the business volumes of BTC, which present the impact of US retailers.

BTC’s demand stays comparatively secure, since Altcoins has did not explode, whereas memes are thought-about brief -term operations. With the weak point of Ethereum (ETH), BTC maximalists proceed to emphasise the significance of controlling BTC in a self -limited pockets. Google Searches It additionally doesn’t present indicators of capitulation, remaining in a comparatively excessive baseline.