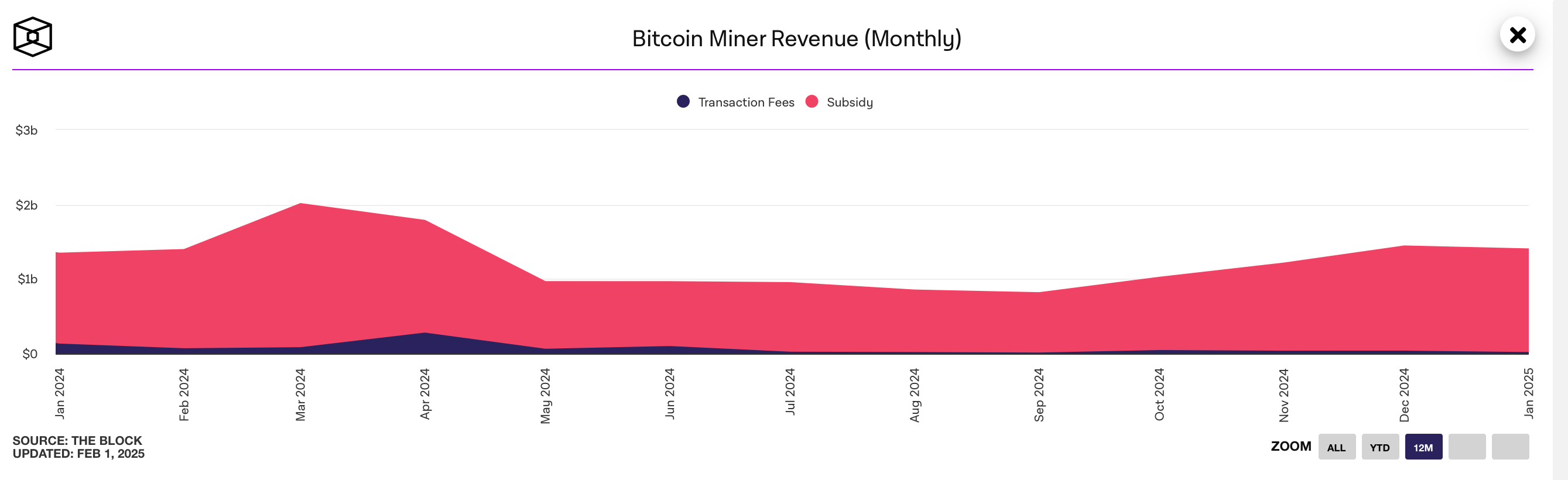

The info collected from the primary month of 2025 reveal that Bitcoin mining revenues reached $ 1.4 billion for January, following final month’s figures at roughly $ 40 million.

First month of 2025: Bitcoin mining revenue displays the December figures

Statistics reveal that Bitcoin miners obtained round $ 40 million lower than in December, marking the second most worthwhile month within the final 9 months. The metrics from Theblock.co point out that December generated $ 1.44 billion in revenues from the subsidy and mixed charges.

Roughly $ 39.38 million of the mixture had been amassed in chain charges. Of the $ 1.4 billion registered in January 2025, the charges represented $ 20.37 million. These outcomes point out a nuanced atmosphere for Bitcoin miners.

Whereas Ochain charges revenue and Bitcoin costs fluctuate, sustained income spotlight operational viability amid situations of evolution. Miners should negotiate price dynamics and market competitors as adaptability of revenue reflexes.

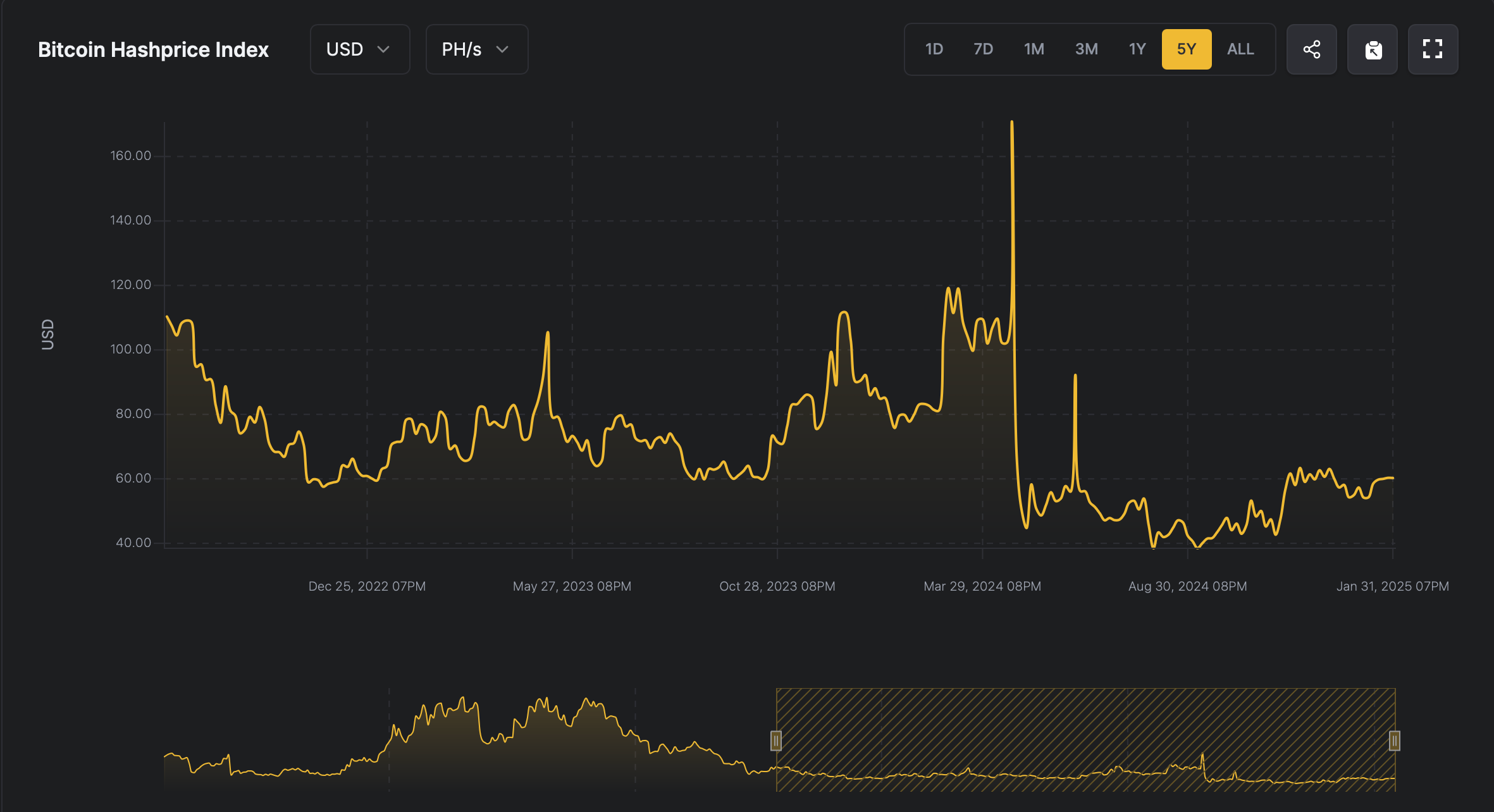

Just lately, Bitcoin.com Information reported that the miners are in lack of switch exercise within the block chain, an element which may be behind decrease charges revenue. Regardless of this development, the hashprice worth, estimated by 1 petahash per second (pH/s) of computational energy, is now greater than just a few months in the past.

Bitcoin hashprice between August 2022 to the current.

For instance, on November 4, 2024, 1 Petahash was simply above $ 42, and as we speak is $ 59.94 per pH/s. The overall hashrate of the community has decreased, however stays round 782.98 exahash per second (EH/S), a modest lack of 39 eh/s from the 822 EH/s peak on January 6.

The most recent information indicate that Bitcoin mining stays at an important scenario, asking for strategic flexibility within the midst of fixing financial forces. Each buyers and operators can uncover that adaptability is important to prosper in an atmosphere outlined by gradual operational recalibration.

Others are adopting synthetic intelligence (AI) autos and the adoption of the Bitcoin Treasury (BTC) as a way to mitigate losses. As market parameters change, modern individuals will in all probability modify their methodologies to take care of profitability and make the most of rising alternatives with agency conviction.