The value of bitcoin (BTC) was unstable and elevated by 9 % previously 30 days, however final week it decreased by 3 % and the market capitalization was about $ 2 trillion. Regardless of the latest unfavourable points, the BTC appears to be built-in as a result of the EMA line has been intently traded and the DMI chart reveals a weak development power.

However, the variety of BTC whales has dropped to the bottom stage in a single yr, suggesting that some massive holders are off -road. With the principle help of $ 101,300 and the $ 105,700 resistance, the subsequent motion of the BTC is necessary to find out whether or not to proceed integration or push for $ 110,000.

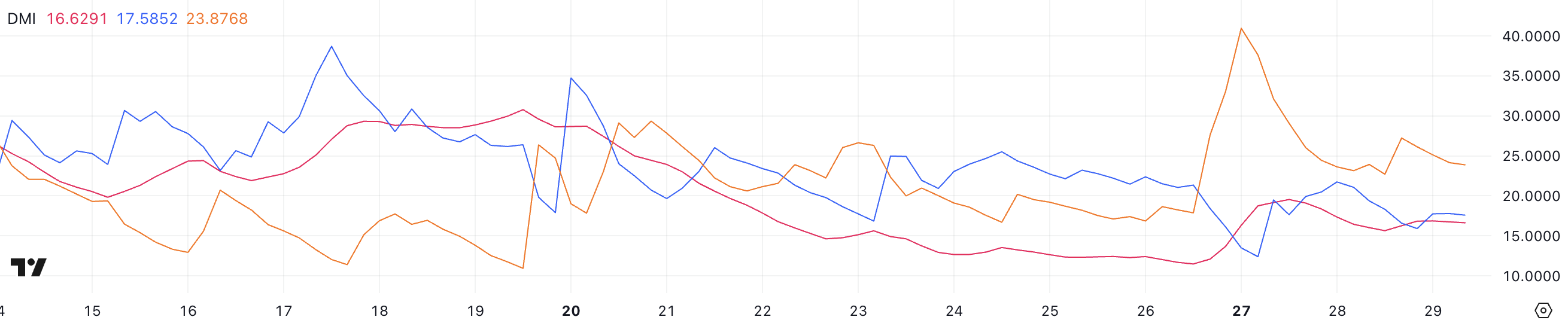

Bitcoin DMI reveals uncertainty

The Bitcoin DMI chart signifies ADX in 16.6, which fluctuates between 15 and 19 previously two days, indicating that the development is weak. The ADX measures the power of the development, signifies the combination of lower than 20, suggesting a robust development when it exceeds 25. At the moment, BTC lacks clear momentum in each instructions.

BTC DMI. Supply: TradingView

The DMI chart additionally signifies that +DI and -di lower from 27.2 to 23.8 at 17.5. Particularly, -di peaked two days earlier than the BTC peaked at 40.9, which dropped from $ 105,000 to $ 98,600 in just a few hours. This means that the bear strain has been alleviated, and the BTC is at present built-in.

If the +DI rises ADX, the rise development could also be fashioned. In any other case, the BTC value could also be within the vary or the earlier downtrend might proceed.

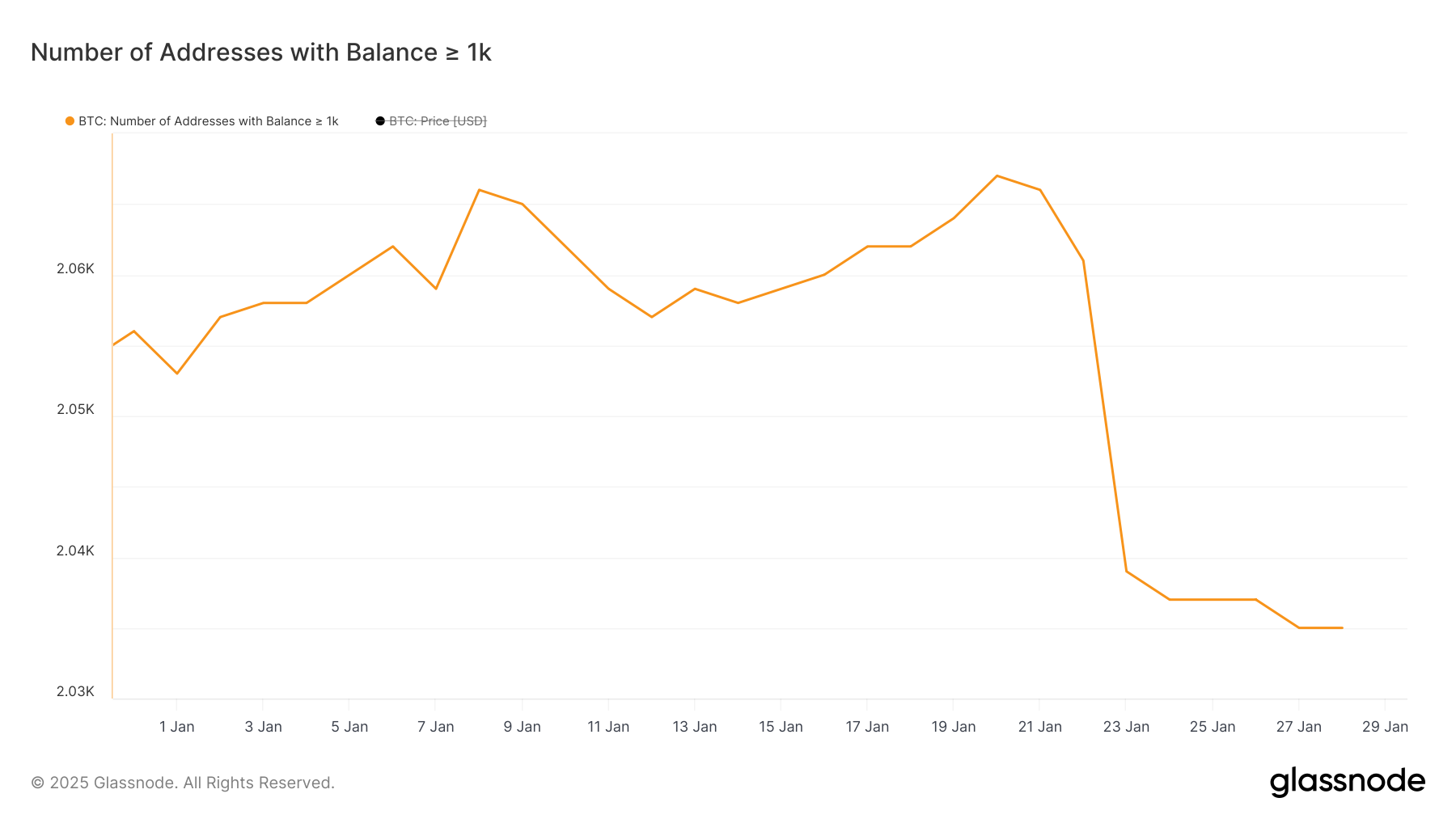

Bitcoin whales are decreased to the bottom stage in a single yr

The variety of BTC whales (handle holding at the least 1,000 BTCs) has dropped to 2,035, the bottom stage since January 2024. A big lower has occurred between January 20 and January 24, when the rely has decreased from 2,067 to 2,037.

This sharp drop means that some massive -scale holders are offloading BTC, doubtlessly rotating to different cash or holding cash ready for brand new actions. 。

Greater than 1,000 BTC addresses. Supply: Glassnode

The monitoring of BTC whales is necessary as a result of it has a majority of bitcoin provide and may have an effect on market traits. The lower in whale handle might point out a distribution. In different phrases, massive holders promote as an alternative of accumulating.

As a result of the variety of whales is low for the primary time in a yr, the BTC value might face the rise in gross sales strain, making it tough to take care of a robust upward momentum. Nonetheless, if a brand new accumulation is began, it’s going to present help and assist stabilize the market.

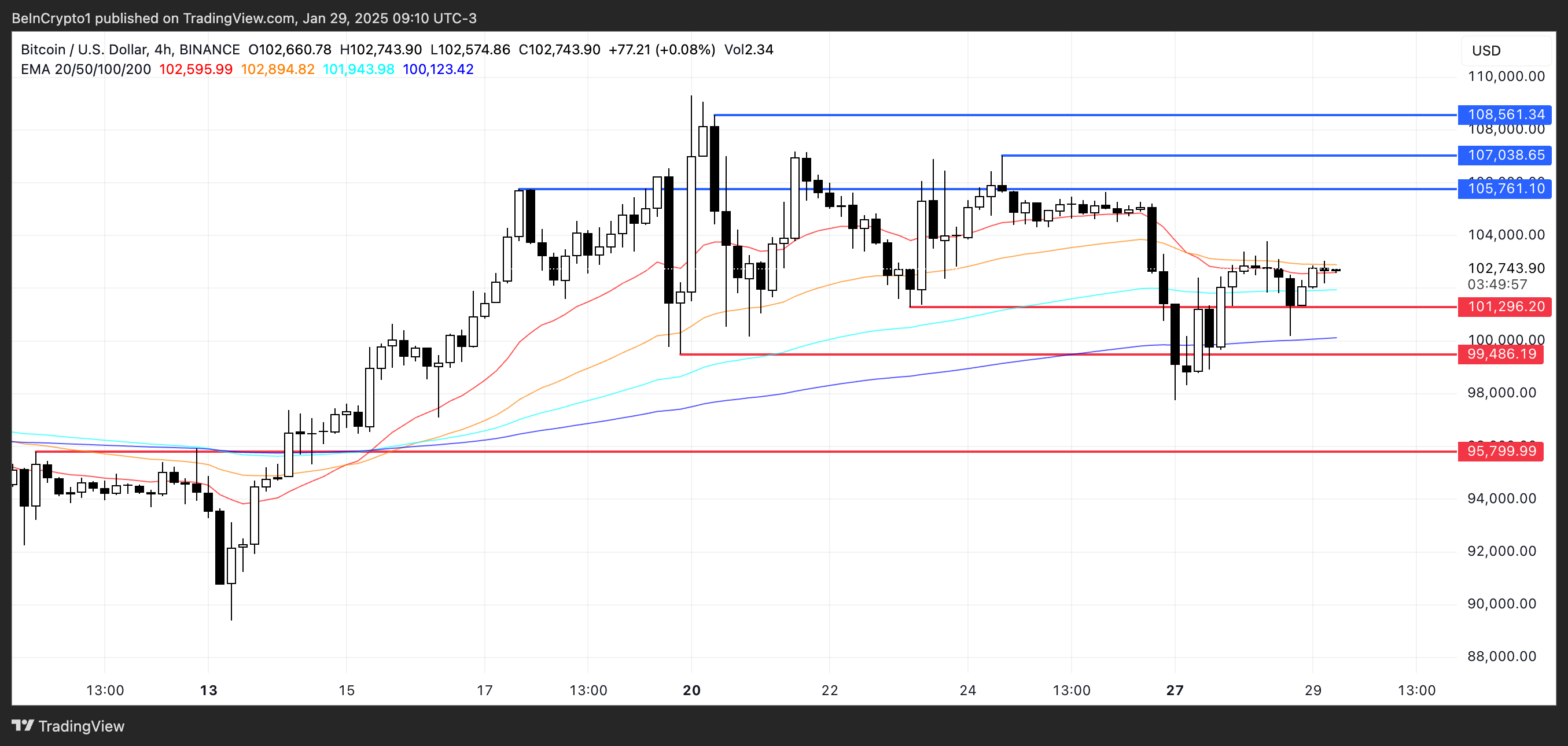

BTC value prediction: Will it lastly attain $ 110,000 in February?

The Bitcoin EMA line reveals an built-in part as a result of it trades intently. The present help stage is about $ 101,300, which has been held thus far.

Nonetheless, if the worth take a look at of bitcoin and this help are misplaced, it may be additional decreased to $ 99,400, and a deeper lower can attain $ 95,800.

BTC value evaluation. Supply: TradingView

As a bonus, if the BTC positive factors momentum, you’ll be able to take a look at the resistance for $ 105,700. Breakouts exceeding this stage can push the BTC value to $ 107,000 to $ 108,500, and for the primary time to maneuver to $ 110,000.